Developments of the new prudential regime for investment firms under IFR/IFD

In December 2019, the European regulatory authorities introduced the Investment Firms Regulation (EU) 2019/2033 (IFR) and the Investment Firms Directive (EU) 2019/2034 (IFD) as a new prudential framework for investment firms hitherto monitored based on the regulatory requirements applicable to the banking sector, namely the Capital Requirements Regulation (CRR). These pieces of legislation gave the European Banking Authority (EBA) various mandates covering a broad range of areas. In June 2020, the EBA published a roadmap detailing the planned deliverables and their respective publication deadlines.

Abbildung 1 High-Level scheduling of final EBA submissions (source: EBA Roadmap on Investment Firms.docx (europa.eu)).

Previously, we published an insight introducing the IFR/IFD and explaining the EBA’s roadmap. The present insight discusses some of the IFD/IFR mandates subsequently issued by the EBA und gives an overview of present and upcoming requirements along the six areas as per the roadmap’s classification: thresholds and criteria for investment firms, capital requirements and composition, reporting and disclosure, remuneration and governance, supervisory convergence and Supervisory Review and Evaluation Process (SREP), and ESG exposure.

Thresholds and criteria

The draft RTS on prudential requirements for Investment Firms were made available in 2020 and specified aspects related to the IFR’s classification of investment firms into three classes, according to which the different requirements apply:

Class 1 investment firms with total assets exceeding EUR 15 billion for which the requirements of the CRR apply,

Class 3 investment firms, consisting of those with a balance sheet of less that EUR 5 billion and for which IFR/IFD do apply with some exemptions and eventually

Class 2, a residual class, that covers all other investment firms which need to comply with all areas of IFR/IFD.

In December 2021, the EBA published a package of two final draft RTS on the reclassification of investment firms as credit institutions and on the provision of information for effective monitoring of the credit institution thresholds.

The former, referred to in Article 8a (6) point (b) CRD, sets out the methodology to calculate the EUR 30 billion threshold that would trigger the obligation for investment firms to apply for a banking license. In the draft legal text, priority is given to IFRS accounting standards, with the possibility to use EU local GAAPs if the undertaking belongs to a group that does not use IFRS.

The second RTS was mandated under Article 55 (5) IFR. Investment firms which obtained an authorisation to be treated as a credit institution are required to monitor their positions and their group’s position with respect to the thresholds triggering their classification. The EBA therefore introduced two templates to be submitted on a quarterly basis by investment firms to their competent authority:

I 10.01 – Verification of total assets at individual level and group test

I 10.02 – Total assets for group test broken down by entity

Capital Requirements and Composition

In principle, the capital requirement for investment firms is clearly described in article 11(1) of the IFR: Investment firms should at all times have own funds equal to the highest of the following (Article 11(1) of the IFR):

a) their fixed overheads requirement calculated in accordance with Article 13;

b) their permanent minimum capital requirement in accordance with Article 1; or

c) their K-factor requirement calculated in accordance with Article 15.

However, the specific calculation and interpretation of the mentioned parameters is quite complex in detail. Therefore, various guidelines and technical standards have been published in this regard, providing further detail on eligible own funds instruments and funds for small investment firms, the calculation of the fixed overheads requirements, the measurement methodology for each of the K-factors (the factors introduced by the IFR in order to take into account the business model when determining own funds requirements) and, eventually, the scope and methods for prudential consolidation of an investment firm group.

To supplement the calculation of the fixed overheads requirement as one of the main elements necessary for the determination of capital requirements for investment firms, Article 13(4) of the IFR mandated EBA to developed technical standards in consultation with ESMA that were published in December 2020. This RTS defines a subtractive approach for calculating the fixed overheads requirement, meaning deduction of variable costs from the total expenses calculated according to the applicable accounting framework (IFRS). The methodology is also applicable to smaller and limited-authorisation investment firms which do not use IFRS. The draft also specifies the notion of ‘material change’, enabling competent authorities to make adjustments to own funds requirements.

Several publications deal with the different K-factors which are clustered in three categories. The publications refer to most of the Risk-to-Client K-factors and some of the Risk-to-Firm K-factors. Risk-to-Market K-factors are either defined as references to the CRR or were already detailed in the IFR. The overall K-factor requirement is defined as the sum of those three K-factor requirements. Some of the aspects clarified are the notion of “segregated accounts” for calculating the K-factor “client money held” (K-CMH), the daily trading flow for market makers (K-DTF) or the clearing margin for calculating the total margin required when determining the K-factor “clearing margin given” (K-CMG).

On 31 May 2021, the EBA, together with ESMA, published a list of eligible own funds instruments and funds for class 3 firms, which is maintained on a regular basis. Legal background is article 9(4) of the IFR that allows class 3 investment firms to use additional instruments and funds as own funds if these qualify for the treatment under Article 22 of Council Directive 86/635/EEC.

The IFR also defines the liquidity requirements for investment firms in Article 43(1), specifying an amount of liquid assets equivalent to at least one third of the fixed overhead requirement. If the investment firm meets the conditions of a class 3 investment firm, it can be exempted from liquidity requirements set out in Article 43(1) of the IFR. The criteria that competent authorities should take into account when exempting class 3 investment firms from liquidity requirements are now set out in the Guidelines on liquidity requirements exemption for the class 3 investment firms published in July 2022. For class 2 investment firms, the liquidity requirements set out in Article 42 of the IFD do apply. These consist of so-called “specific” liquidity requirements, stemming from the results of an investment firm’s supervisory review and evaluation process (SREP). The corresponding RTS, mandated by Article 42(6) of the IFD, was published in November 2022.

Reporting and Disclosure

In March 2021, the EBA published a draft ITS on reporting and disclosures requirements for investment firms referred to in Article 54 (3) and Article 49 (2) IFR, respectively. These requirements are only relevant for Class 2 and Class 3 investment firms, since Class 1 investment firms are subject to the CRR/CRD framework. Class 2 investment firms should submit the reports quarterly, whereas Class 3 investment firms have to submit them once a year at the accounting year-end. Disclosures are done at the end of an investment firm’s financial year for both classes.

Abbildung 2 Overview of reporting and disclosure obligations for investment firms (source: Technical standards on reporting and disclosures for investment firms | European Banking Authority (europa.eu))

Class 2 investment firms are required to submit information about their own funds, size and level of activity thresholds, K-factor requirement, concentration risk, and liquidity requirements. Following the principle of proportionality, Class 3 investment firms must provide information on own funds and in some cases liquidity requirements in addition to the size and level of activity thresholds which could trigger a shift into another classification and, subsequently, a change of the reporting requirements. Class 2 and 3 investment firms which make use of the derogation provided in Article 8 IFR[1] upon authorisation from the competent authority are required to report a group capital test on own funds composition, own funds instruments, and information on subsidiaries’ undertakings. The reporting requirements for Class 2 and Class 3 investment firms are summarized in the figure below.

Abbildung 3 Reporting obligations for class 2 and class 3 investment firms.

All firms subject to the IFR/IFD prudential regime, i.e., Class 2 and Class 3 investment firms, are required to disclose their own funds information. The EBA’s draft ITS includes three templates:

• IF EU CC1 – which captures the necessary information on the composition of own funds and a description of all restrictions applied to their calculation. Following the principle of proportionality, a simpler template is provided for Class 3 investment firms.

• IF EU CC 2 – which includes a full reconciliation of Common Equity Tier 1 items, Additional Tier 1 items, Tier 2 items and applicable filters and deductions applied to own funds of the investment firm and the balance sheet in its audited financial statements. This template is relevant for both Class 2 and Class 3 investment firms.

• IF EU CCA – which provides users with a description of the main features of the Common Equity Tier 1 and Additional Tier 1 instruments and Tier 2 instruments issued by the investment firm. This template applies to both classes with issuances of Additional Tier 1 instruments.

In addition to own funds disclosure, Class 2 investment firms are required to disclose the proportion of voting rights attached to the shares held, a complete description of voting behaviour, an explanation of the use of proxy advisor firms, and the firm’s voting guidelines. In October 2021, the EBA submitted the final draft RTS on disclosure of investment policy by investment firms to the European Commission under a mandate of Article 52(3) IFR, which puts forward a number of templates and tables (where templates are used to disclose quantitative data, whereas tables implement disclosure requirements for qualitative information) to be disclosed on an annual basis alongside financial statements:

• IF IP1 – Template on proportion of voting rights

• IF IP2.01 – Table on the description of voting behaviour

• IF IP2.02 – Template on voting behaviour

• IF IP2.03 – Table on explanation of the votes

• IF IP2.04 – Template on voting behaviour in resolutions by theme

• IF IP2.05 – Template on the ratio of approved proposals

• IF IP3.01 – Table on the list of proxy advisor firms

• IF IP3.02 – Table on the links with proxy advisor firms

• IF IP4 – Table on voting guidelines

Remuneration and Governance

In November 2021, the EBA published its final reports on guidelines on internal governance. It promotes a clear organizational structure and adequate internal control mechanisms, stressing transparency and the role of the second and third line of defence by requiring internal governance arrangements to be reflected, managed and comprehensively documented for the internal control and risk management units.

In the same month, the guidelines on sound remuneration policies under the IFD for Class 2 investment firms were published, supplementing the remuneration requirements under the Markets in Financial Instruments Directive (MiFID II) and ensuring that remuneration policies promote sound and effective risk management and respect the principle of gender neutrality. Investment firms are to adhere to these guidelines since 30 April 2022. Class 2 investment firms must apply certain policies to all staff and some specific requirements for the variable remuneration of staff whose professional activities have a material impact on the risk profile of the investment firms. Particularly, the regulations highlight that remuneration policies must be gender-neutral and respect the principle of equal pay for male and female workers for equal work or work of equal value. Investment firms must fulfil the proportionality principle that aims to match remuneration policies and practices consistently with the investment firms’ risk profile, risk appetite and strategy.

Based on article 34(2) IFD, the EBA published its final guidelines on the remuneration benchmarking exercise. These guidelines apply since 31 December 2022 and have to be taken into account for the data provision due at the end of August 2023, whereas the former data collection exercise regarding high earners from 2014 has been repealed.

Supervisory Convergence, Supervisory Review and Pillar 2

The latest guidelines and RTS in the area of IFR/IFD were published in July 2022 and concern the supervisory convergence, specifically the procedures and methodologies for the SREP and pillar 2 add-ons. A scoring system was introduced to ensure comparability along the common criteria set for the SREP-assessment, including risks to capital and liquidity, governance and the business model.

The main objective of these guidelines is to ensure consistency in supervisory practices in the assessment of Class 2 and class 3 investment firms by specifying SREP procedures and methodologies. Additionally, the guidelines provide guidance for subsequent supervisory measures that a competent authority should consider.

The guidelines explicitly state the proportionality principle, considering the investment firms’ different sizes and business models of and their nature, scale and complexity. In particular, investment firms are classified into four distinct categories, which translate into different frequency, depth and intensity of the assessments, and the engagement of the competent authority.

Abbildung 4 Overview of the common SREP framework (source: Final report on SREP guidelines under IFD.pdf (europa.eu))

As for pillar 2 add-ons, the mentioned guidelines provide very detailed approaches for setting add-ons on the basis of the outcome of the SREP assessment for the supervisory authorities. Most notably, whereas for both class 2 and class 3 investment firms additional own funds requirements are to take into account the risk of an unorderly wind-down and the subsequent threats to the wider markets, risks related to ongoing activities are to be considered only in case of class 2 firms.

ESG Exposure

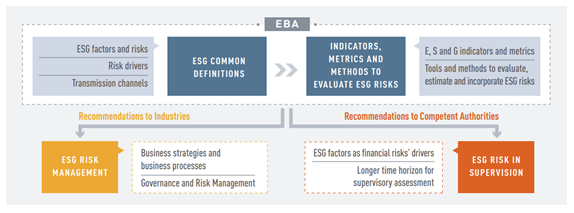

The Report on management and supervision of ESG risks for credit institutions and investment firms that was published in June 2021 laid down some guiding principles in the context of ESG: a common definition of ESG risks, recommendations for institutions as well as supervisors on how to incorporate ESG risk-related considerations, and a proposal for a phase-in approach, starting with the inclusion of climate-related and environmental factors and risks into the supervisory business model and internal governance analysis, whilst encouraging institutions and supervisors to build up data and tools to develop quantification approaches to increase the scope of supervisory analysis to other elements.

Abbildung 5 Overview of dependencies and content of the EBA’s approach to ESG Risk Management and Supervision (source: EBA - ESG risks management and supervision factsheet (europa.eu))

In October 2022, the EBA published the Report on the integration of ESG risks in the supervision of investment firms, supplementing the aforementioned report with a focus on investment firms. Especially, this report is strongly related to procedures and methodologies for the SREP of investment firms, providing an assessment of how ESG factors and ESG risks could be integrated in all elements considered under the supervisory process, including: business model analysis, internal governance and risk management, and assessment of risk, including capital and liquidity risk. Finally, the EBA’s roadmap on sustainable finance was published in December 2022, picking up various initiatives and explaining the sequenced approach for the upcoming years in order to integrate ESG risks in the banking framework.

All this guidance should be understood in conjunction with the disclosure publications under the CRR, the Taxonomy Regulation, and the Sustainable Finance Disclosure Regulation (SFDR).

Achieve your goals with Finbridge

Finbridge supports you in fulfilling the regulatory requirements under IFR/IFD. Our experts have worked at the German Bundesbank, the Single Resolution Board and providers of regulatory reporting software. They actively engage in impact studies and implementation projects in the context of regulatory supervision with years of experience and can assist you in tackling the challenges ahead with well-founded expertise. Thanks to our comprehensive know-how in overall bank management and our extensive practical regulatory experience, we can flexibly cater for the specific needs of your institute and help you meet the expectations of supervisory authorities. Do you have any questions? Our expert team would gladly assist you in planning and implementing your projects.

Authors: Houssem Ben Romdhane, Dijana Duronjic, Alexander Schiller, Raphael Steßl

Annex: List of EBA mandates under IFR/IFD

You can find a complete list of all published EBA-mandates in the pdf version.

![Hedge Accounting [Part 2]: Prospective Testing and the Risk Induced Fair Value](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1592205162143-L919DBQ2UQF59D4R9WFH/jeff-fan-29ebQh7e78M-unsplash.jpg)

![Hedge Accounting [Part 1]: Prospective Testing and the Risk Induced Fair Value](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1591683719107-BDZ43MTDO65RH9XKXBG6/christopher-burns-FUh6nK3s0po-unsplash.jpg)