Resolvability Planning in Progress

Situation

About eight years ago, the Single Resolution Mechanism entered into force and only shortly after, the Single Resolution Board (SRB) began its work in Brussels. Since then, many areas of resolvability planning have progressed well and banks are receiving ever more specific guidance and obligations.

MREL and TLAC and the corresponding reporting being already enshrined in the banks‘ business-as-usual activities, it is best practice to integrate MREL ratios into recovery plans as early warning indicators, and generally to monitor them more closely. Especially so, since a violation of the MREL target can lead to a limitation of the maximum distributable amount under CRR2/BRRD2, apart from a substantive impediment procedure.

Furthermore, bail-in implementation is still a hot topic. Details, e.g. about the interactions with external parties, are to be clarified and especially data provision is providing a lot of potential for development. More specific requirements regarding operational continuity and access to FMIs has been public for a quite a while now, but also here, the devil is in the detail and e.g. providing well-maintained service catalogues that depict all interdependencies is a challenge. The focus is going to be on other areas as well: Most recent guidance of the SRB relates to separability and liquidity. Regarding the latter, the SRB published for the first time a Staff Working Paper on estimating liquidity needs in resolution a few days ago (Staff working paper: Estimating liquidity needs in resolution in the Banking Union | Single Resolution Board (europa.eu)).

EfB Phase-In 2022-2023 (source: SRB Work Programme 2022 (europa.eu))

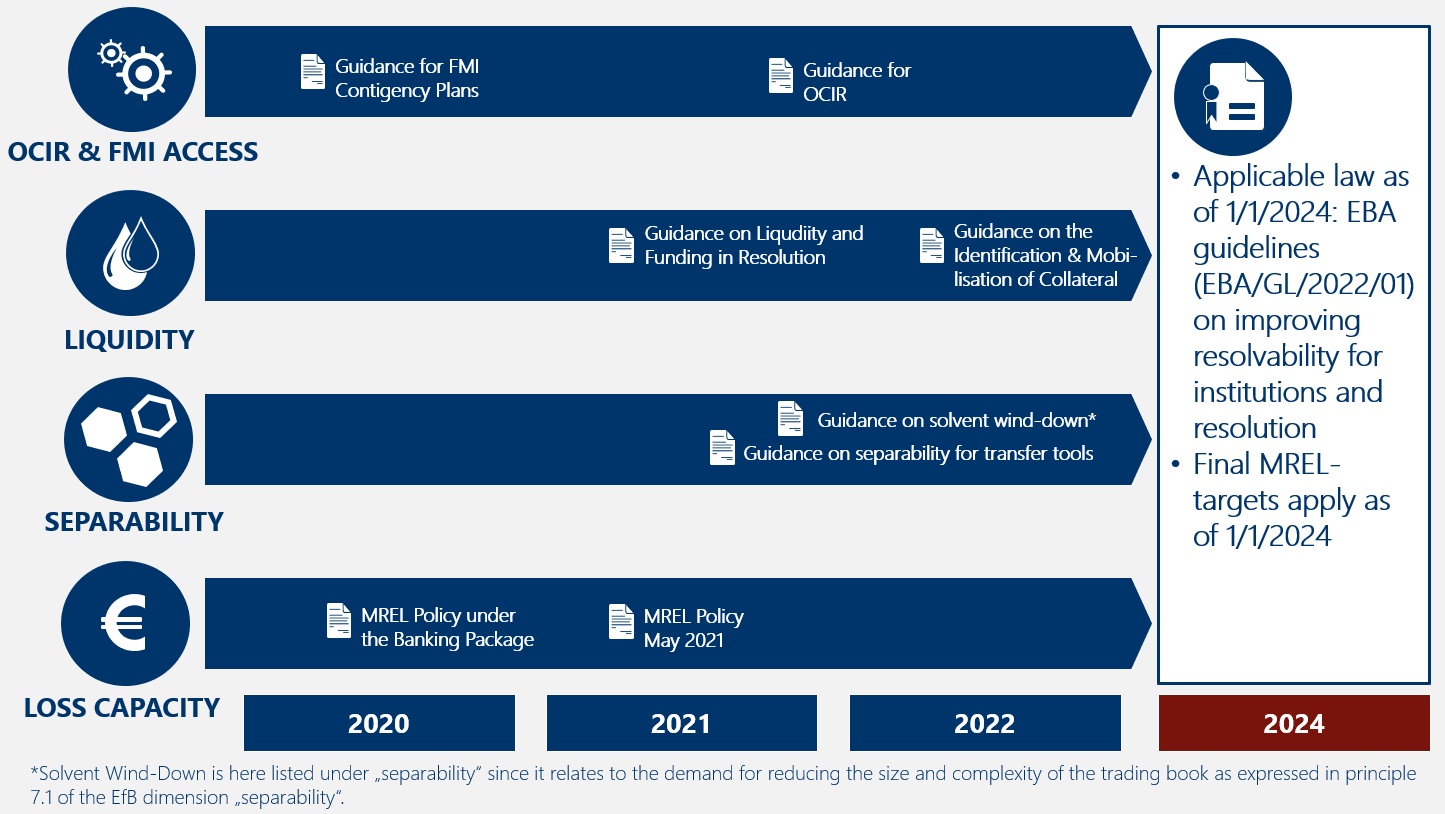

The Expectations for Banks (EfB) that should be implemented by 2024, are thus put more and more into practice. As soon as the Guidelines for institutions and resolution authorities on improving resolvability | European Banking Authority (europa.eu) that were published at the beginning of this year are going to be legally enforceable, these requirements, that mostly reflect the EfB, are going to apply as of 1 January 2024.

Selection of publications for areas of the EfB

Challenges

The special thing about resolvability planning is that the implications of resolution that have to be assessed are always having an impact on the whole bank. This puts governance structures to test. From front-end, to risk controlling up to accounting and communication – everything shall work in parallel and co-ordinately. Organisational structures must function vertically and horizontally. On top of that, there is communication with external stakeholders. The ability, to maintain the necessary data and to provide it within the predefined time windows is an essential point. Here, there are again synergies and dependencies to requirements formulated in BCBS239.

Regulatory reporting and resolvability planning are linked by nature. Six reports are currently reported on a regular basis, disclosure requirements regarding MREL and TLAC will follow as of 1/1/24. Depending on the company structure and the resolution strategy, the real number of templates that have be to reported are a multiple of that. Furthermore, there are deliverables in relation to playbooks, the prior permissions regime or the impracticability notifications according to art. 55 BRRD.

Overview Resolution Reporting

Also, the regulatory reporting team is often located in the finance and risk controlling departments, which is where there is usually the greatest interest in a functioning data architecture. Here, there are further chances to integrate the requested information into the data systems and dovetail them with the internal reporting in a meaningful way.

At the beginning of this month, the SRB published its bi-annual reporting note to the Euro-Group (20220404 SRB bi-annual reporting note 2022.pdf (europa.eu)). Among the current priorities, the resolvability heatmap, that was mentioned before in the SRB Work Programme 2022, is again announced. This should allow for a common evaluation and therefore a benchmarking of banks regarding their resolvability capabilities, based on the dimensions of the EfB. In summer, results of the heatmap analysis shall be made public. Currently, the reporting note states, banks have made most progress on the areas that have been in focus, while G-SIIs are more advanced in governance and loss absorption capacity. „Significant progress“ is expected in the areas, that are in focus for the current and the next resolution planning cycle: Liquidity, adequate information systems, separability and restructuring after bail-in.

Achieve your target with Finbridge

Finbridge supports you with the implementation of the resolvability planning and regulatory reporting requirements. Our experts have worked at the German Bundesbank, the SRB and providers of regulatory reporting software. They engage in impact studies and implementation projects in the context of resolvability planning and supervision actively with years of experience and can assist you with the challenges ahead with well-founded expertise. Because of our comprehensive know-how about overall bank management, together with the wide experience in practice with resolvability planning, we can flexibly cater for the specific needs of your institute, and we accompany you to the accomplishment of the expectations of the national resolution authorities.

Do you have any questions? Our expert team gladly assists you with planning and implementing your projects.