Finbridge conducted a Benchmarking Study in the field of Resolution Planning. This posting gives an overview of the study’s essential findings and an outlook for 2024.

WeiterlesenBoth the ECB and the EBA are currently working in parallel on the topic of an integrated reporting system. This shall allow financial institutions to provide comparable, uniform and redundancy-free data. In this article, we give an overview of current delevopments and explain the application using concrete examples.

WeiterlesenLiquidity in Resolution is one of the seven dimensions of the EfB and one of the current working priorities of the SRB. Apart from further literature about liquidity by the FSB and the ECB, the SRB has published three publications about liquidity in resolution on its website. We analyse the content of these publications and give an overview of existing and upcoming requirements.

WeiterlesenInsurers must address fundamental strategic issues. It is more important than ever to anticipate emerging trends and prepare for change. For insurers to keep up, they need to leverage targeted technologies to increase digital maturity across the entire customer relationship and value chain and provide their customers with a seamless, unique and tailored service experience. Tomorrow's insurers will have little in common with those of today. Six theses on how new technologies and the availability of enormous amounts of information will fundamentally change the world of insurers.

WeiterlesenAbout eight years ago, the Single Resolution Mechanism entered into force and only shortly after, the Single Resolution Board (SRB) began its work in Brussels. Since then, many areas of resolvability planning have progressed well and banks are receiving ever more specific guidance and obligations. An overview of recent publications and current priorities.

WeiterlesenThe wider acceptance and active development of machine learning techniques and data analytics have made it possible to optimize and automate business processes. This presents a lucrative opportunity for banks to redesign their operations to cut processing times and improve transparency. We present the potential of these techniques by applying a machine learning approach to a hidden reserves/losses process that can often be found in the finance departments of banks.

WeiterlesenIn recent years the financial system’s regulators have worked towards discontinuing the existing reference rates for unsecured lending within the interbank market (IBOR, Interbank Offered Rate). Consequently, the important LIBOR (London Interbank Offered Rate) will most likely not be published anymore already by end of 2021.

That is why banks need to adapt their IT-systems towards a new interest-methodology to be able to offer lending being based on the new reference rates.

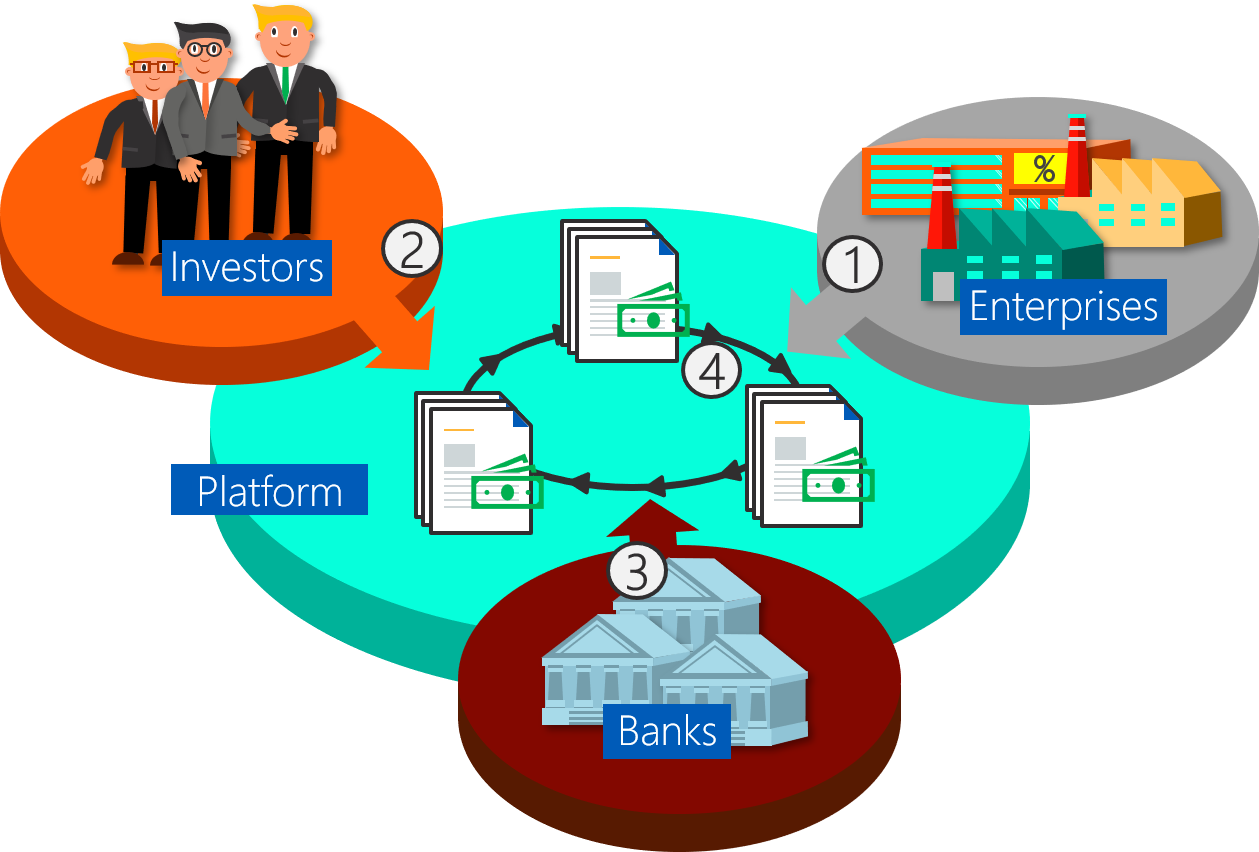

WeiterlesenThe Schuldschein market has seen an unseen spring of digital platforms, offering a digitized Schuldschein process, and supporting the boost of the Schuldschein in terms of transaction volume and deal numbers. The traditional process bears several inefficiencies that can easily tackled by shifting the process onto a digital platform. A platform can enhance standardization, transparency and processing time significantly. This article provides a current view on the platform evolution in the Schuldschein market.

Weiterlesen