Resolution Planning Benchmarking Study and Outlook 2024

Background

The year 2023 is the final year for banks to implement the measures to meet the resolvability requirements that were first set out in the Expectations for Banks in 2020. From 2024, these will be legally binding for institutions supervised by the SRB.

Against this background, this benchmarking study was conducted with nine different institutions, looking at selected topics along the principles and dimensions of the Expectations for Banks. It shows which approaches the institutions chose to meet the requirements as well as their current state of implementation and where the resolution authorities still expect further work to do.

The detailed report of the Study has been provided to the participants exclusively. This Insight summarizes essential findings.

Participants

A total of nine banks took part in the study, consisting of two private banks and seven banks that can be classified under the category publicly-owned/cooperative banks (e.g. banks owned by the German federal states or Savings Banks). For one bank, the balance sheet at end-2022 amounted to more than 350 bn. EUR, for two to more 160 bn. EUR. Among the other institutions, three each ranked in the range of 30-60 bn. EUR and 90-160 bn. EUR.

With the exception of one institution, a single point of entry (SPE) approach with bail-in as the preferred resolution strategy (PRS) is pursued at all surveyed participants - in three cases also in combination with sale of business (share deal). The remaining institution represents a non-resolution entity for which an internal loss transfer mechanism to the parent company is sought. For the most part, the variant resolution strategy (VRS) is a combination of bail-in and sale of business (SoB). In cases where bail-in and SoB are already the preferred strategy, the alternative strategy involves an asset deal or a bridge institution instead of a share deal. No alternative strategy was communicated for a total of three institutions.

Seven of the surveyed institutions are based in Germany and two in other (non-German-speaking) EU countries.

Two of the institutions only became resolution entities retrospectively and may therefore have started some work later or will not have to comply with various requirements until later than the beginning of 2024. Where relevant, this is explicitly mentioned in the individual principles.

Figure 1 Overview of the participants’ attributes

Key Findings

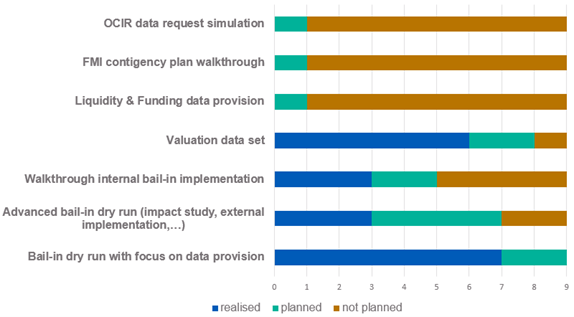

The results of the survey show differences in some areas, both in terms of banks' activities and supervisors' expectations. For example, on the subject of testing, almost all institutions have been carrying out or are currently planning dry runs in connection with a bail-in, whereas only a few institutions are already actively working on tests in the fields of liquidity or operational continuity.

Figure 2 Performed and planned testing activities

The further procedure with regard to testing activities is also heavily dependent on the requirements from the EBA guidelines on resolvability (EBA/GL/2022/01 and EBA/GL/2023/05). While various institutions expected that the interaction with the EBA guidelines would be addressed in the working priorities for 2024 sent out in October, this unfortunately did not happen. Instead, it was determined across the board that one activity for all institutions considered by the SRB is testing in the area of valuation. In addition, almost all institutions have received requests to carry out further dry runs in the area of bail-in.

Figure 3 Adjustments to the data basis in the context of mobilizing collateral

The Study has shown that regarding the bail-in playbook, most institutions are approximately at the same stage. However, for some institutions, deeper focus on bailing-in of upper ranks of the insolvency hierarchy is required by the supervisory authorities and topics of the internal loss transfer mechanism or the restructuring plan have been explicitly put on hold, whereas the opposite is the case for some other comparable institutions. When it comes to collateral mobilization (with regard to the liquidity dimension), almost all institutions came to the conclusion that funding via central banks or the Single Resolution Fund (SRF) is the most realistic option in the event of a resolution, whereas only one of the surveyed banks has also made requests to their IT-units to adjust its internal data household in order to identify assets that are neither marketable nor eligible for ordinary Central Bank funding, but could be mobilized in different ways.

Figure 4 Responsibility for the creation/update of the service catalogue

When it comes to the topic of operational continuity in resolution, most institutions were surprised by the underlying complexity. Here again, different approaches had been taken, mostly due to the variety of starting-points in the banks. This concerns the data basis of the service taxonomy - mostly processes or a kind of process clusters, but also cost allocation registers - as well as the regular internal responsibilities for the service catalogue, which was still unclear for a third of the participants.

In some areas, the approaches of the interviewed institutions are very similar, which can generally be explained by the content-related issues and the clear organisational assignment. The latter holds true, for example, for the topic of communication in resolution - the dimension that, despite of its importance, probably caused least work for the institutions and generated the fewest queries from the supervisory authorities. Here, all interviewed institutions consider the status of their communication plan and the corresponding governance to be very advanced and have been receiving marginal comments from the authorities. The topic of valuation occupies almost all institutions in a similar manner, whereas a high level of effort is typically being required here such that two-thirds of the interviewed banks are carrying out major implementation projects. Finally within the separability dimension, the restructuring plan or work on transferability is relevant depending on the respective resolution strategy. In the latter case the approaches of the interviewed institutions are again similar, while for the restructuring plan, clear supervisory guidance has been lacking.

Outlook 2024

As outlined earlier in this article, the institutions under the SRB’s remit have received their working priorities for 2024 in recent weeks. The priorities, which are identical for the entire banking sector, include the aforementioned testing of the Valuation Data Set. On the other hand, there is a further focus on the topic of liquidity in resolution. It is expected that the Joint Liquidity Templates of the ECB and the SRB, which were submitted for the first time this year, will be submitted again. The specific focal points communicated to the institutions are based on past work and individual resolution strategies. Further dry runs in the area of bail-ins or details in separability analyses or the drafts for the core bank are required at various institutions.

In addition to the focal points mentioned in the Working Priorities, the EBA guidelines on resolvability (EBA/GL/2022/01 and EBA/GL/2023/05) must also be taken into account. Although these are not explicitly mentioned in the letters to the banks, the guidelines themselves require institutions to prepare a self-assessment report against them by the end of 2024. By the end of 2025, the resolution authorities must then submit a multi-year test programme to the institutions, which in turn should prepare a draft for an initial master playbook by the end of 2025. In principle, it is to be expected that the resolution authorities will position themselves on these requirements over the course of the coming year.

Finbridge as your partner for Resolution Planning

Finbridge supports you in implementing the requirements for Resolution Planning. Some of our experts have worked for the Bundesbank, the SRB and providers of regulatory reporting software. They have many years of experience on the market in preliminary studies, test calculations and implementation projects in the context of resolution planning and supervisory law and can provide you with value-adding support for all the challenges with their in-depth experience and expertise. Thanks to our comprehensive knowledge in overall bank management, coupled with extensive implementation-oriented practical experience in all aspects of Resolution Planning, we can respond flexibly to your wishes and the specifics of your institution and support you until the expectations of the resolution authorities are met.

Do you have questions about the technical changes in detail? Our experts will be happy to assist you with their technical expertise in planning and implementation.