Liquidity in Resolution

Background

Liquidity in Resolution is one of the seven dimensions of the EfB (Expectations for Banks) and one of the current working priorities of the SRB (Single Resolution Board). Apart from further literature about liquidity by the FSB (Financial Stability Board) and the ECB (European Central Bank), the SRB has published three publications about liquidity in resolution on its website: the operational guidance on liquidity, the operational guidance on the identification and mobilisation of collateral and the staff research paper on estimating liquidity needs that we mentioned in our insight dated April 27. The latter two have only been published in spring this year.

Figure 1: Classification and brief description of SRB publications on liquidity in resolution

Together, these publications specify the requirements stipulated in the EfB which eventually are going to become legally binding via the Guidelines for institutions and resolution authorities on improving resolvability | European Banking Authority (europa.eu) as of 1 January 2024.

Fundamental requirements

Starting point for the more detailed publications are the three principles of the EfB that a bank should comply with in order to be resolvable (see figure 1). A bank should be able to

1) estimate the potential liquidity needs that would arise in a resolution event;

2) measure and report the liquidity situation during a resolution event;

3) mobilise collateral in order to obtain additional liquidity.

While estimating liquidity needs including the simulation of at least two scenarios (fast and slow moving) has been a working priority for 2021, the current focus lies on the identification and mobilisation of collateral. All three principles are clearly connected. However, one can fairly assume processes and reporting regarding liquidity during resolution are going to be a focal point in 2023.

Key Liquidity Entities

Ahead of everything else, the so-called KLEs (Key Liquidity Entities) within the concerned banking group have to be identified in order to determine the central and pivotal points of liquidity and funding and therefore the scope of resolution planning. Banks should have finalised this work by now.

Initially, all RLEs (Relevant Legal Entities) according to the definition applicable in the context of MREL and the submission of the Liability Data Template are defined as KLEs, i.e. each group entity that either provides critical functions or contributes at least 3% of the consolidated leverage exposure, risk-weighted assets or operating income. Additionally, all other entities that could be relevant for liquidity and funding, e.g. asset management or insurance companies have to be assessed. If a RLE is not considered a KLE, this has to be justified.

Based on the identification of the KLEs, a liquidity map of the bank has to be created which should display the liquidity and funding set-up for the group in resolution. This analysis should clarify the differences between the business-as-usual and resolution funding activities and highlight which role each KLE would play, to what extent it could autonomously manage its liquidity and whether changes and dependencies between the individual KLEs are expected in resolution.

Figure 2: Exemplary representation of funding connections of a bank (Source: A Map of Funding Durability and Risk (financialresearch.gov))

Figure 2 is illustrative for a funding map that shows the different actors and departments that could play a role in business-as-usual funding activities. Such connections and dependencies have to be explained for all KLEs, between KLEs and taking into account resolution specifics.

Estimating liquidity needs in resolution

As described above, this area has already been a supervisory focus during 2021. Some specific deliverables are or have been clear: Identification of risk drivers, estimation of known key figures or simulation of scenarios to name a few. Many institutions have been asked to submit updated versions of their scenario analysis. When developing the methodology for estimating liquidity needs, banks have to take into account certain resolution-specific elements, but they still do have some leeway. This is due to the fact that coherent approaches still need to be assessed and determined. Another reason is that regulators understandably stick to the credo that banks know best which challenges they face and that each bank has to consider its individual specificities.

On 4 April, the SRB has published its staff working paper on estimating liquidity needs in resolution. This paper for the first time describes a concrete methodology for the ex-ante estimation of potential liquidity needs and therefore indirectly provides banks with a specific example of how to estimate liquidity needs. The authors describe two scenarios based on different assumptions that basically depend on the presumed timing of intervention by the resolution authority.

The working paper has explicitly been published for informatory purposes only and does not reflect the SRB’s position. The aim is rather to foster public debate concerning liquidity in resolution.

The methodological framework can be explained by the following figures, which describe the two scenarios assessed in the working paper:

Figure 3: Schematic representation of the methodological framework (FOLTF at NLP < MLBT=7) - Depiction following the example used in the SRB Staff Working Paper „Estimating liquidity needs in resolution in the Banking Union“.

The central metric is the net liquidity position (NLP, [1]) of a given bank. The NLP is defined by the sum of counterbalancing capacity and the difference between its positive and negative cash flows for the period considered. All of these amounts are derived by the Template C66 from the AMM-report (maturity ladder). The development of the NLP is put in context with the timing of intervention by the resolution authority.

In the baseline scenario, this moment is defined as the point in time once the NLP falls below the minimum amount of liquidity necessary to operate in the upcoming week (MONT=7, [3]), again derived from the AMM-template. This moment is therefore institution-specific. For those banks under the SRB’s remit and for which the authority has analysed the data, the NLP amounts on average to 28% of the LCR-Outflows (the denominator used for calculating the LCR ratio, i.e. the expected outflows of the next 30 days under stress).

In the alternative scenario (figure 4), the intervention of the resolution authority is assumed to take place once the NLP falls below the minimum operating amount needed for the next 30 days (MONT=30, [3]).

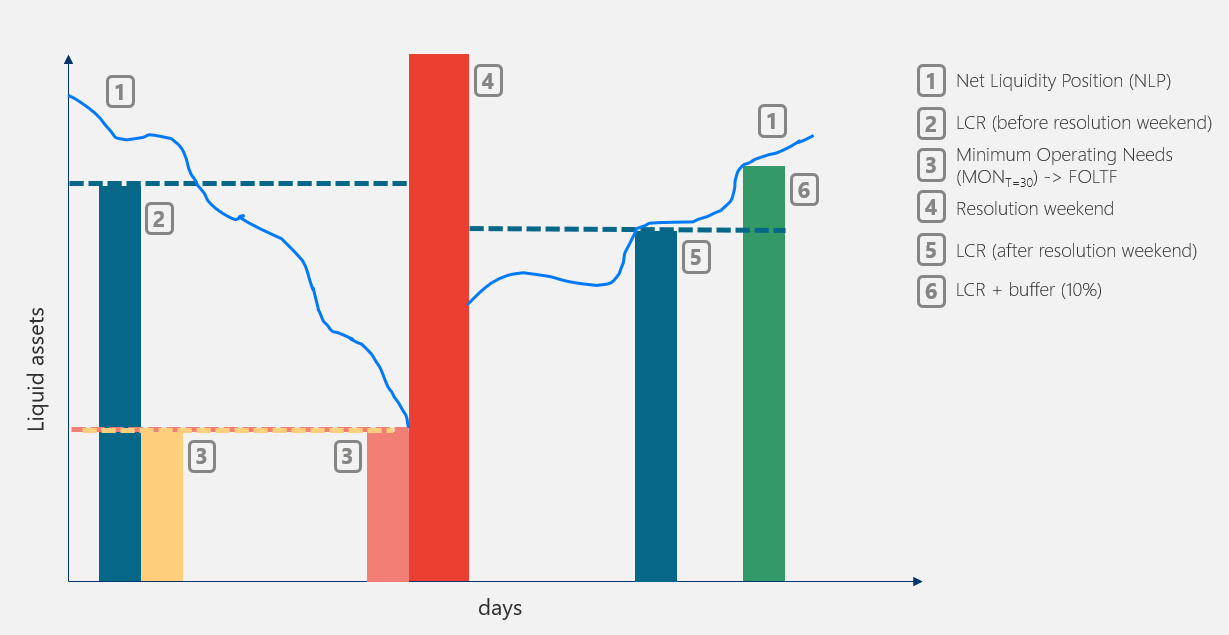

Figure 4: Schematic representation of the methodological framework (FOLTF at NLP < MLBT=30) - own illustration based on the Technical SRB Staff Working Paper „Estimating liquidity needs in resolution in the Banking Union“.

The resolution authority would therefore intervene earlier in this alternative scenario: Based on the data assessed by the SRB, this would take place, on average, once the NLP falls below 52% of the LCR-Outflows.

Thus, both scenarios differ with regard to the moment of intervention by the resolution authority or, in other words, the point in time that a given institute would be declared “failing or likely to fail” (FOLTF) because of its liquidity situation. Consequently, the correspondent funding gap differs as well. The funding gap is defined as the difference between the NLP when the bank is declared FOLTF and the liquidity needs, whereas the latter depends on a given time horizon and the underlying objective: Short-term, the target is to cover the minimum operating needs for the next 30 days ([5] in figure 3). Medium-term, the aim to fulfill the LCR-requirement of 100% (based on the balance sheet after the resolution weekend, [6] in figure 3, [5] in figure 4). Long-term, the objective is to have a 10% buffer on top of the LCR requirement of 100% [7] in figure 3, [6] in figure 4).

The assessments are based on the assumption that the resolution authority would intervene due to liquidity issues only, which e.g. differs from what is expected from banks to take into account in their scenario analysis. According to the SRB’s calculation for the data sample, the estimated liquidity needs in resolution would amount to, on average, 5 to 9% (baseline scenario) or 3 to 6% (alternate scenario) of total assets. For outliers, this figure amounts to up to 28%.

Identification and mobilisation of collateral

The identification and mobilisation of collateral plays a key role in resolution, as collateralised funding can generate essential liquidity flows for the bank. Against this backdrop, the SRB published the Operational Guidance on the Identification and Mobilisation of Collateral on 17 March 2022, which sets out legal and operational requirements for the identification and mobilisation of collateral.

In terms of governance, banks are expected to explain in detail all responsibilities related to collateral management activities, address key performance indicators related to collateral management and assess what changes would occur as a result of a resolution event. These expectations are summarised in figure 5:

Figure 5: Requirements of the Operational Guidance on the Governance of Collateral Management

Furthermore, when identifying collateral, the bank is expected to have the competencies to identify and locate all assets that can be used as collateral in resolution. Therefore, the entire asset side should be classified based on the criteria of central bank eligibility and marketability as displayed in figure 6:

Figure 6: Overall presentation of the assets to be identified - Own representation based on “Table 1: Collateral asset classes” in the “Operational Guidance on the identification and mobilisation of collateral in resolution”.

The non-central bank eligible and/or non-marketable assets are the focus of the Operational Guidance. The background is that in a resolution case, all central bank-eligible and marketable collateral will probably be encumbered, which means that the bank must also consider assets for liquidity generation that are to be regarded as non-marketable. It is precisely these assets that could continue to be available in resolution and would be an option to mobilise additional liquidity.

In this context, the Single Resolution Fund (SRF), among others, provides a framework to enable refinancing through these non-marketable and/or non-central bank eligible assets.

Figure 7: Description of the Single Resolution Fund

To ensure the identification of the assets listed in figure 6, the relevant management information systems (MIS) must be in place. MIS refers to all computer-based information systems that are required for the valuation and documentation of collateral. In accordance with the requirements for MIS, relevant data for the specified assets must be readily available. Since, as described above, all assets on the balance sheet are to be considered, this is a requirement for the provision of data in particular.

The mobilisation should make it possible to use assets as collateral in resolution promptly and without complications in order to be able to generate new liquidity for the bank quickly. For this purpose, the bank should examine whether there are possible legal and operational obstacles to the mobilisation of the types of assets shown in figure 6, which private counterparties are available for funding and how long a mobilisation would take, including the implementation in IT systems and the drafting of corresponding contracts. Depending on the category of assets, further requirements and guidelines for analysing a possible mobilisation are given.

Figure 8: Asset mobilisation requirements

For non-central bank eligible assets, data for a valuation must be provided and possible counterparties must be identified. Furthermore, it must be documented how the respective institution has proceeded with mobilisations in these cases in the past and how flexibly collateral management can react to changing requirements. This is related to the required gap analysis in terms of central bank and market eligibility to be able to determine the extent to which affected assets can be mobilised, if necessary at the SRF or in case of weakened central bank collateral criteria, as was the case e.g. in April 2020 to address potential liquidity shortages related to Covid-19. If assets are neither central bank eligible nor marketable, an analysis regarding the experience with the Additional Credit Claims (ACC) framework must be carried out and it must be documented which data points required by the ACC template can be provided by internal data systems, how corresponding assets are identified and how long it has taken to identify such additional assets in the past. It is explicitly stated that the SRB in principle reserves the right to accept assets as collateral at its discretion.

For assets in foreign countries that are central bank eligible but not marketable, it should be examined to what extent they can be mobilised at the respective local central banks outside the Eurozone (e.g. Czech Republic, Poland, Hungary) as well as outside the European Union, as cross-border mobilisation can be associated with obstacles. The focus here is on past experiences and legal aspects. Depending on the business model and geographical footprint of the institution (e.g. focus on real estate financing), a large source of mobilisable assets can be found here, which could be used through subsidiaries that represent KLEs and are located in the respective countries.

Thus, the following approach can be identified for asset mobilisation: First, all assets must be classified according to figure 6. This should not leave any assets for which it is unclear whether they constitute central bank eligible collateral. Based on the classification, it can be assessed which assets are eligible for mobilisation at all and to what extent, and whether the associated effort is justified. This also includes the analysis of the most suitable type of liquidation depending on the asset, such as sale or use in repo transactions, as well as the type of collateralisation, such as a transfer of ownership, pledge or, if applicable, a floating charge. In the following, the steps shown in figure 8 can be carried out depending on the data basis.

Challenges

The implications and tasks of the requirements and guidelines are manifold. As is often the case in resolution planning, horizontally and vertically connected departments and organisational units of a bank are affected. The required estimations can usually be covered well with some work on methodology by the treasury divisions in interaction with risk controlling and the regulatory reporting groups. Several parties along the value chain must be involved in the identification and mobilisation of collateral: Here, we see the tasks on the one hand in terms of processes and structures (collateral governance, conception of possible mobilisations) and on the other hand with a focus on data and legal issues.

In addition, the requirements regarding liquidity management in resolution (Principle 3.2) will be specified in the near future. For the time being, this will cover the entire topic of "liquidity in resolution planning" for the time being. As the past has shown, e.g. in the case of bail-in implementation, the requirements surrounding the topic of liquidity will then probably become more granular and the expectations higher: After the discovery phase and evaluation of the submissions of the various institutions from the Banking Union, the SRB will continue to work on ensuring an even progress of the supervised institutions.

Achieve your target with Finbridge

Finbridge supports you with the implementation of the resolvability planning and regulatory reporting requirements. Our experts have worked at the German Bundesbank, the SRB and providers of regulatory reporting software. They engage in impact studies and implementation projects in the context of resolvability planning and supervision actively with years of experience and can assist you with the challenges ahead with well-founded expertise. Because of our comprehensive know-how about overall bank management, together with the wide experience in practice with resolvability planning, we can flexibly cater for the specific needs of your institute, and we accompany you to the accomplishment of the expectations of the national resolution authorities.

Do you have any questions? Our expert team gladly assists you with planning and implementing your projects.