Open Banking: Opportunity or Threat for Banks?

Open Banking or API Banking - the opening of the traditional banking sector to third-party companies – has become a major topic in finance. It’s not only the new Payment Services Directive (PSD2) of the EU, affecting all banks located in the EU, that leads to an energized, pioneering atmosphere. More and more IT-driven developments result in banks having to deal with the question of how to position themselves in a future market with not only plenty of new business opportunities, but also numerous new competitors on the rise. Open Banking is certainly strongly transforming the financial sector. It challenges the traditional structures and has the potential to revolutionize the entire industry.

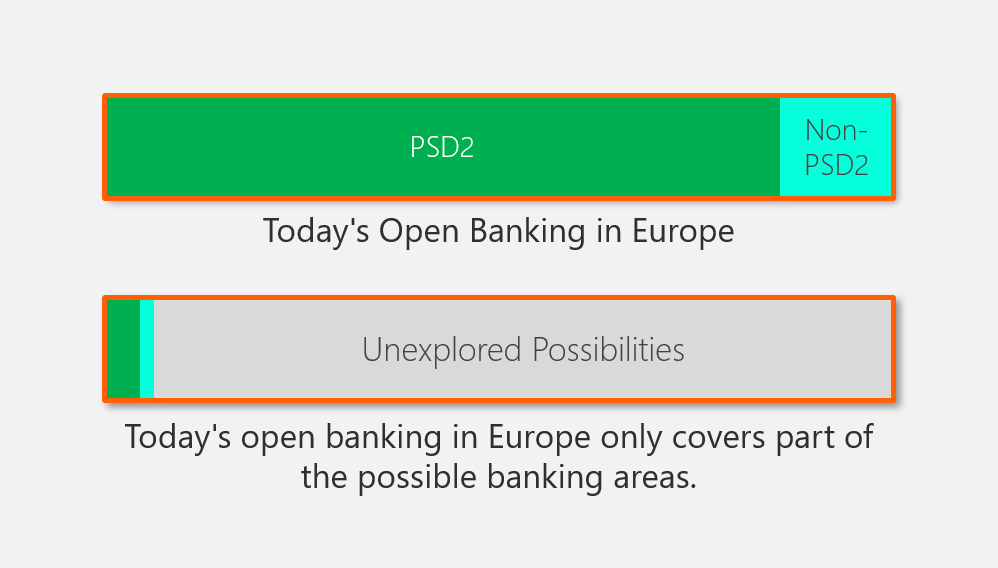

Figure 1: Open Banking in Europe

Source: Finbridge

What is Open Banking?

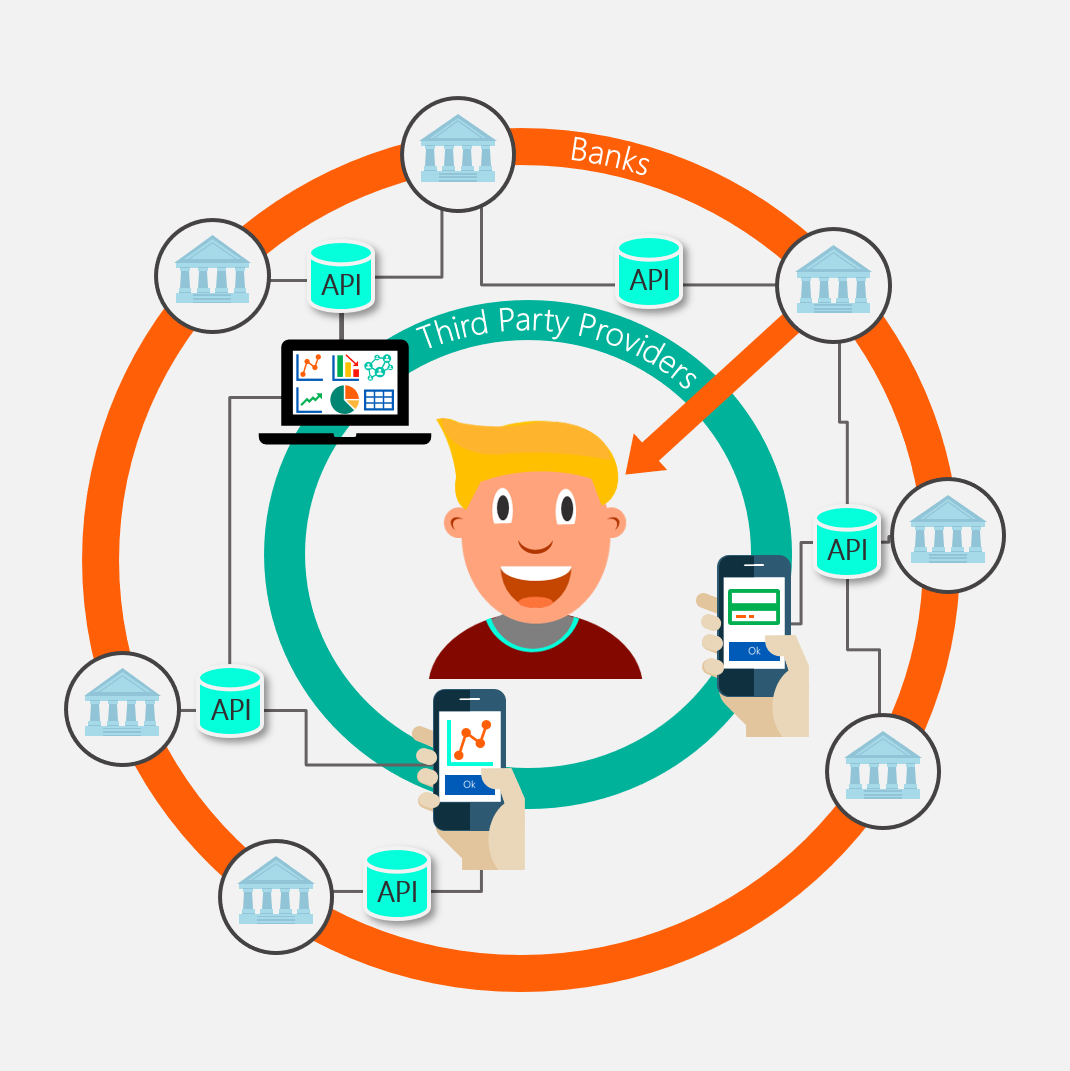

In general, Open Banking describes the opening of banks to third-party providers, such as FinTechs or e-commerce companies. It particularly concerns the provision of customer data and the outsourcing of specific financial services. In Europe, Open Banking is currently being driven by the new EU Payment Services Directive (PSD2), which concerns mostly payment transactions and account management services. However, the concept of Open Banking potentially extends to all business areas in the financial sector: Thorough digital networks of banks, third-party providers and customers make it possible to share data with and use data of all potential players in the market, framed by data privacy protection regulations. New business areas can be opened up and further providers enter the market with new solutions entirely focused on the customers’ needs. Open Banking means to create an integrated marketplace with specialized roles for each participant that enables a seamless exchange of data and services.

How does it work?

The technical backbone of Open Banking is the use of Application Programming Interfaces, or APIs in brief. APIs can be best described as abstract, modular source codes, similar to those already in use by other digital platforms such as Facebook or Google. Via APIs, external providers can directly communicate with the banks’ infrastructure to e.g. access data or trigger transactions. Ideally, APIs are standardized, such that they can be equally used by all participants without any hurdles. Due to the interconnectedness of all market participants, typical banking products and services can be offered without directly holding a banking license via third-party providers. This way, customers are not bound anymore to the service array of one particular financial institute. Third-party providers offering such services are for example FinTechs, e-commerce companies or banks that are connected to other banks (via API).

Through Open Banking, it is possible for third-party providers to use the client’s account data from several banks to offer saving- or account management services via their own interfaces. Credit assessments are another example of how APIs allow an easy check for all bank accounts of one customer. Non-banking companies, e.g. for e-commerce, can, on behalf of the customer, trigger financial transactions via APIs or offer complementary credits for their products without having to involve a bank for settlement.

Still, even in an Open Banking world, the traditional financial institutes are essential. Many (new) services might be offered by other, particularly non-banking, participants. There is, however, also the need for licensed institutes fulfilling regulatory requirements as well as maintaining the necessary infrastructure and economies of scale.

PSD2

The Payment Services Dircective 2 (PSD2) is the renewal of the EU Payment Services Directive that has entered into force on 14 September 2019. It obliges all banks in the EU to implement stronger security concepts (Strong Customer Authentication, SCA), to provide data on customers, their accounts and transactions to third party providers (Account Information Services, AIS) and to set up payment initiation services (PIS) which can be used by third parties to initiate transfers and transactions. This is achieved through the mandatory provision of APIs, that are accessible and usable for all market participants.

Why is Open banking frame-breaking?

Customer experience becomes maxim in an Open Banking world – similar to other commercial sectors. The customer benefits from integrated, bespoke and easy-to-use products. By opening the competitive environment, the traditional structures of banking are torn and redefined on new grounds. Still, Open Banking is not only about the banks losing their monopolies on customer data. It also offers the opportunity for banks to re-invent their business model and stay relevant for their (future) customers.

By establishment of PSD2, European banks are obliged to offer APIs in the context of payment transactions only. Simultaneously however, the financial sector’s evolution towards Open Banking is just getting started. Many traditional institutes will therefore have to reposition themselves in the longer term in order to find their role in a restructured banking environment.

Open Banking as an opportunity

Figure 2: depicting banking APIs

Source: Finbridge

Open Banking comes with fundamental changes for the financial sector. The perception is mixed: Euphoria from third-party providers, rather reserved enthusiasm on the side of the banks. Though, the developments aren’t necessarily bound to reduced business opportunities and increasing competition for banks. Traditional financial institutes in particular have a promising starting condition: the available expertise, a large number of customers and their longtime trust form a reliable base for the own future-proof repositioning and restructuring. It is in their hands to transform the challenges into opportunities:

Data is the new oil. Banks can reposition themselves as the central data pool provider, since they do not only share their data with third-party providers, but also collect and aggregate their clients’ data from third-party providers and other banks. Due to data analytic services, business clients can, for instance, benefit from comprehensive process optimizations, outsource internal interfaces for accounting and regulatory reporting or offer their own reporting services.

New business opportunities. It’s not only the third-party providers who benefit from Open Banking by offering new services: Banks can equally use APIs to offer custom-fit and innovative products to their customers.

For example, banks can act as orchestrators and generate value added for their customers by hosting own platforms that combine different services in one place – own services and those from third-party providers. In this regard, traditional financial institutes have a rather favorable position: They possess an established branding, a strong customer basis and a high volume in transactions. Additionally, a significant advantage is given by the trust of their customers.

Focus on core business / Banking as a Platform. The outsourcing of certain services via APIs to third-party providers does not necessarily have to be coupled to losses. In contrast, this can be an opportunity for banks that e.g. do not have direct customer contact (B2B2C banks). When banks only act as a provider for infrastructure, there is no longer the need to maintain costly customer relations, e.g. via marketing or branches. In the model “banking as a platform”, banks benefit from their experience with sensitive data and risk management, additional to holding a banking license, which permits them to perform financial transactions.

Benefit from economies of scale. Strategic co-operations with third-party providers can be of benefit. By the distribution of certain services via different third-party providers, new economies of scale can be achieved. For instance, a bank’s product can be sold by several third-party providers, employing a revenue-sharing model. In this scenario, the products reach more customers compared to the single distribution channel of the selling bank.

Minimum dependency on (core) software products. There is also the possibility of cost cutting by Open Banking. In principle, it is possible for banks to make all data and functionalities available via APIs – internally and externally. Since APIs are, more or less, standardized (at least, that is the target), also the connection of two (or more) systems itself can be realized without greater effort. As an example, data migrations are facilitated and interfaces to third-party providers can be made available (almost) by the push of a button. The existing IT-infrastructure therefore is, in consequence, more flexible and easily optimizable.

Open Banking means change

The opening and modernization of banking lies just in front of us – the first steps have been made and it will result in an enduring, irreversible change of the entire industry. Banks can hardly avoid this transformation, particularly - but not only - due to the mandatory adoption of the PSD2 API-ruleset. Right now, it is up to the traditional banks to exploit the existing competitive advantage and to build and implement a future-proof strategy. Banks now have the opportunity they should not miss: To restructure and digitize their business models and infrastructure in order to keep the attention of the digital-native generations. In the long run, this will save the banks’ position and make them stay relevant for their customers and future generations.

Key aspects therefore are the development of highly integrated services as well as the own (re-)positioning in a vertically extended supply chain with an increasing differentiation of all players.

Open Banking should be seen as the starting movement of a fundamental transformation of financial markets. Investing in this development early means saving oneself the best position for the future.

List of references:

[1] “PSD2 und Open Banking: Was wird nun aus den Banken?”, retrieved on 08/28/2019, https://www.der-bank-blog.de/psd2-open-banking/strategie/32969/

[2] “Das Einmaleins des API-Banking: Was jeder Bank-Manager über Banking APIs wissen sollte!”, retrieved on 08/28/2019, https://knowledge.fintecsystems.com/blog/einmaleins-des-erapi-banking

[3] “Understanding APIs in Banking 2017 - Trends, Drivers & Best Practices in Open Banking”, Report von Open Bank Project (2017), retrieved on 09/02/2019, https://www.openbankproject.com/wp-content/uploads/2018/10/BANKING-APIS-2017.pdf

[4] “World Retail Banking Report 2017: Open Banking fordert klassische Banken”, retrieved on 09/02/2019, https://www.it-finanzmagazin.de/world-retail-banking-report-2017-open-banking-fordert-klassische-banken-51887/

[5] “Open Banking unter PSD2 wird konkret”, retrieved on 09/02/2019, https://www.moneytoday.ch/news/open-banking-unter-psd2-wird-konkret/