The German Schuldschein: A Niche Instrument On The Rise

In the recent years, an old-aged financial instrument, the German Schuldscheindarlehen, has gained a lot of importance in the corporate financing market. With a volume of nearly EUR 21 billion in the first nine months of the year (2019), it will continue its drive since 2014. The traditional deed-based instrument, Germany-based and once owning a rather sedate and dusty reputation, now also attracts growing interest in international markets. With lower documentation requirements than a bond, higher transaction volumes than a loan combined with a high level of standardization, the Schuldschein more and more stands out as a save and appealing way to invest and an uncomplicated way for companies to acquire external financing. In this article we explain what’s behind this trending instrument, highlight its main features and shed some light on the current market.

What is a Schuldschein?

The Schuldschein is a deed-based financial instrument that combines characteristics of a corporate bond, a classic loan and a syndicated facility. Under the German Civil Code, the Schuldschein is a private placement – a bilateral loan agreement which is exempted from any complex MiFID II regulation. The absence of any securities prospectus requirements and low documentation obligations endorses a high degree of flexibility and makes the process of a Schuldschein significantly quicker and cheaper compared to e.g. the issuing a corporate bond. At the same time, as opposed to loans, Schuldscheindarlehen are issued unsecured and are hence less restrictive regarding covenants. This allows companies to tap volumes above a classic loan amount, possibly financed by multiple investors, while not having to go through all the costly efforts of issuing a bond or passing a complex syndicated loan process. The Schuldschein also is a valuable opportunity for smaller enterprises that lack access to capital markets.

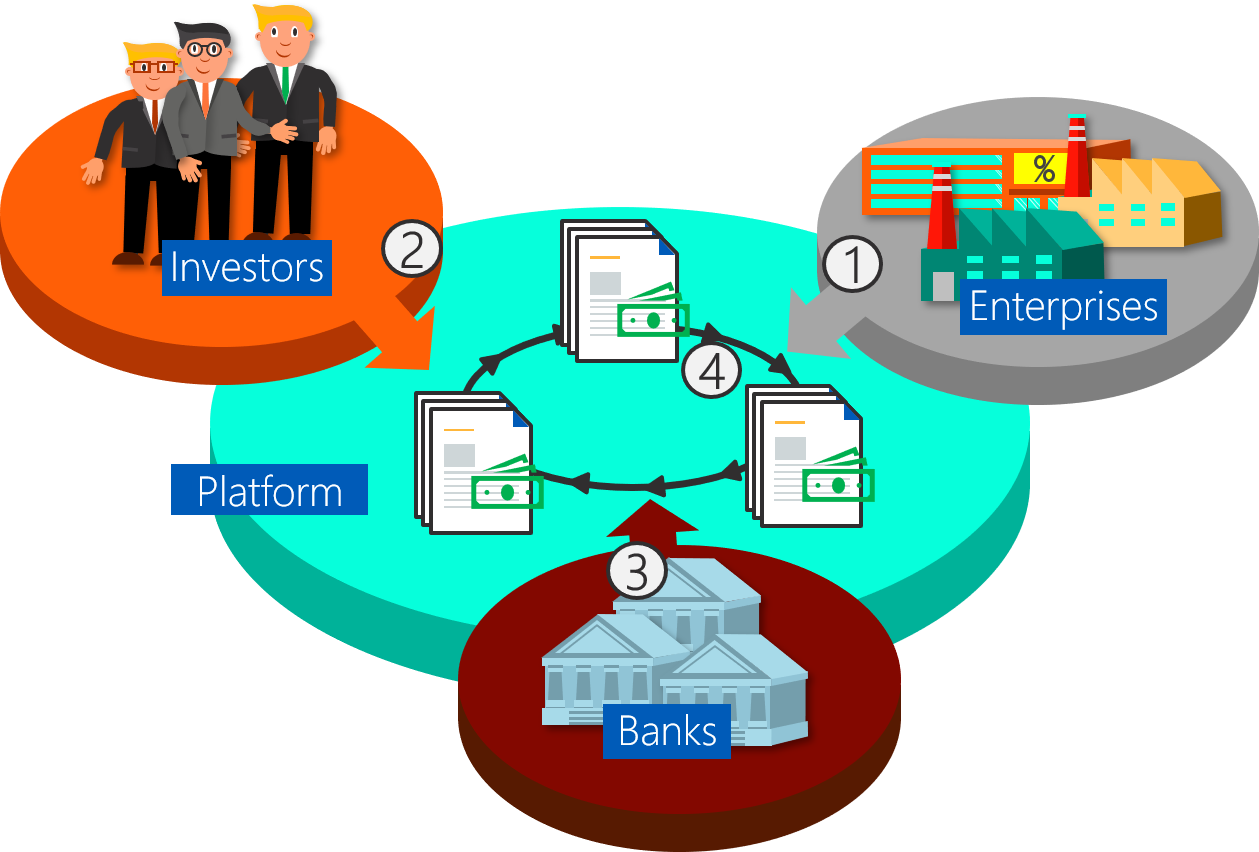

Typically, the Schuldschein process entails three main parties: The issuer, the investor and an arranger, traditionally a bank. Investors are typically institutional entities, such as banks or insurance companies, conducting a buy-and-hold-strategy. Issuers are typically companies with a turnover of 150 million to 5 billion. Banks usually act as an arranger channeling the Schuldscheindarlehen, leading negotiations and offering deal advice. In most cases, they also act as an investor.

The main characteristics

While a bond typically starts at a volume of EUR 500 million, issuing a Schuldschein can already pay off at a volume of 10 million. The typical Schuldschein volume ranges between EUR 20 million and 500 million. However, recent digitization offensives (Schuldschein platforms) have brought significant efficiency improvements, enabling smaller transaction volumes, too. On the other end, volumes above EUR 2 billion have been reached.

Schuldscheindarlehen are typically used to fund acquisitions or long-term projects as opposed to loans that are often used as working capital financing. The maturity is mostly between 3-10 years and thus rather medium to long-term. Being a private placement, it is highly flexible and offers a way of bespoke financing for companies. The capital can be gained from multiple investors and be obtained at both, fixed and floating rates.

The Schuldschein boom and digitization

Recently, the Schuldschein market has seen an unseen spring of digital platforms, offering a digitized Schuldschein process, and supporting the boost of the Schuldschein in terms of transaction volume and deal numbers. Indeed, although transaction costs are lower compared to a bond, the traditional process bears several inefficiencies that can easily tackled by shifting the process onto a digital platform. A platform can enhance standardization, transparency and processing time significantly. Check out our current view on the platform evolution in the Schuldschein market.

Due to the fact that Schuldscheindarlehen are not publicly placed, oppositions and opportunities are often opaque. Banks are traditionally the key player to bring investors and issuers together. Often, issuers do not have an external rating, nor do they have any other public placements in the market, such as bonds or CDS, that allow to seize their market risk. Thus, the bank also acts as a trust-provider for investors. According to bank statistics, the Schuldschein market is generally considered an investment grade market (BBB or slightly lower)[1,2] .

Compared to a bond, the issuing process is significantly quicker and less complex. While a bond requires a securities prospectus and a large documentation (up to 600 pages), the documentation for the Schuldschein can be winded up with 25 pages. First, the issuing company mandates an arranger and affiliating agents, such as lawyers, to channel the Schuldschein. After the documentation and term sheet preparation (structuring) the investor presentation and the bookbuilding phase follow. Settlement can thus be reached within 6-10 weeks. Throughout the life-cycle of the Schuldschein, the issuer regularly provides compliance reports and financial statements to the investor.

Figure 1: The typical process of a Schuldschein issuance for a first-time issuer.

Source: [1]. Design: Finbridge.

Compared to a loan, the Schuldschein is less restrictive regarding covenants, as the capital is not provided as a bank’s credit, but as an investment. One reason for its growing popularity is the special accounting treatment for investors. As a deed-based instrument, the Schuldschein can be included into the investor’s balance at the nominal value on an accrual accounting basis. Hence, no market price adjustments apply, making it more resilient to market volatilities.

Financing costs, i.e. interest, of a Schuldscheindarlehen are usually slightly higher than those of a bond. The reasons can be twofold: First, because the Schuldscheindarlehen is issued unsecured, investors require a higher risk premium. Second, the Schuldschein is very illiquid: Since it’s a private placement, there is no secondary trade market and, similar to a bond, it is normally amortized via bullet payments. Opposed to the high financing costs are the low transaction costs, resulting from the low documentation requirements.

What's up on the market?

The Schuldschein market significantly grew directly after the financial crisis, as it seemed as an appealing substitute for illiquid, volatile and distressed banking finance. Its real up wind, however, can be observed since 2014. The steady growth is supported by increasing standardization, its growing establishment as a complementary whilst secure instrument, a boom of M&A activity and lastly also the internationalization of issuers. While the share of non-DACH-based issuers was only 8.3% in 2015, it has increased up until 31.6% in 2019 (Jan-Sept). Especially in France, a market fairly familiar with private placements (Euro-PP [6]), the Schuldschein business is gaining in activity.

Figure 2: Evolution of the Schuldschein market: Total transaction volume in EUR billion (left axis, bars) and total number of deals (line, right axis). The red bar is the forecasted prospectus for Q4 2019. Source: [3]*, [4]. Design: Finbridge.

In 2018, the total Schuldschein transaction volume has been EUR 23.4 billion, having failed the record volume of EUR 28.5 billion in 2016, while beating the number of deals (135 to 129). The average deal size also peaked in 2016 with a volume of EUR 221 million per deal, and fluctuating around EUR 175 million in the last two years. For 2019, the prospectus is positive. Having reached a total transaction volume of almost EUR 21 billion until September, around another EUR 6 million of deals are in the pipeline for Q4.

While the Schuldscheindarlehen is especially beneficial for companies having trouble to access the capital markets, large enterprises dominate the numbers in terms of transaction volumes. Until October, the biggest deals have been issued by ZF Friedrichshafen AG (EUR 2.1 billion), Porsche (Dr. Ing HFC, EUR 1 billion), and Deutsche Lufthansa AG (EUR 800 million). Most issuers are coming from the industry sector, although the share of other sectors, such as logistics, trade and services increase.

Figure 3: The 10 biggest investors in 2019 (Jan-Sept) by percentage of total deal volume and involved number of deals (shaded area). Source: [3]. Design: Finbridge.

Although banks often own the role of an arranger, they are at the same time the biggest investor group. The investor rankings are steadily led by state-owned banks, such as Landesbanken and Sparkassen, followed by private sector banks. The top three bank investors, more or less steadily, are Landesbanken: the LBBW, the BayernLB, and the Helaba. The LBBW invested nearly EUR 9.5 billion by the end of Q3 of the current year and participated in 42 deals. The BayernLB invested around EUR 6.7 billion, while being involved in 20 deals. Helaba, with a full credit of EUR 5.2 billion by the end of the third quarter, was engaged in 26 deals.

Conclusions

From being a traditional niche product, the Schuldschein has evolved to being a serious alternative for other financing products: Issuers reckon the uncomplicated and cheap procedures to gain external financing while benefiting from increased standardization. Additionally, in light of the surge in liquidity and the lack of investment opportunities in the post-crisis years, the Schuldschein has come in handy as a relatively safe harbor for capital. During the last years, digitization offensives have additionally supported the boom by enabling both smaller and higher transaction volumes, a higher degree of standardization and more transparency, partly challenging the classic role of banks as arrangers. We are keen to observe the future developments of the market and keep you informed about newest developments and trends.

REFERENCES

[1] “Private Placement of Debt Study”, European Commission, 2017, visited 11/25/2019. https://ec.europa.eu/info/sites/info/files/180216-study-private-placements_en.pdf

[2] Financial Career Community Lexikon, website, vitised 11/25/2019. https://web.archive.org/web/20151230015432/http://www.financial-career.de:80/community/lexicon/index.php?entry/10-schuldscheindarlehen/

[3] Finance.Magazin Schuldschein update 032019, visited 11/25/2019. https://www.finance-magazin.de/research/finance-datenbank/#c1578601

[4] “Schuldscheinmarkt im Jahr 2018: Hohes Gesamtvolumennach Belebung zur Jahresmitte”, article, Capmarcon Capital, 10/21/2019.

[5] “Schuldschein: Starkes 3. Quartal Dank hohem Liquiditätsbedarf”, article, Capmarcon Capital, 10/21/2019.

[6] Euro private placement website, Overview, visited 12/02/2019. http://www.euro-privateplacement.com/

![Figure 1: The typical process of a Schuldschein issuance for a first-time issuer. Source: [1]. Design: Finbridge.](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1575299018273-1P4ZL6VMCWQQQEKSX1PK/Bild1.png)

![Figure 2: Evolution of the Schuldschein market: Total transaction volume in EUR billion (left axis, bars) and total number of deals (line, right axis). The red bar is the forecasted prospectus for Q4 2019. Source: [3]*, [4]. Design: Finbridge.](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1575300495753-4D45ZL3833AMB5XU737I/Bild2.png)

![Figure 3: The 10 biggest investors in 2019 (Jan-Sept) by percentage of total deal volume and involved number of deals (shaded area). Source: [3]. Design: Finbridge.](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1575300292279-5ZRSQWSKEPS1MY89HARN/Bild3.png)