The Schuldschein: A Hotbed for Digital Transformation

The boom of the Schuldscheindarlehen persists. With a volume of nearly EUR 22 billion in the first nine months of the year, the Schuldschein will tie in with its boost of the previous years. Nevertheless, the Schuldschein market is still a niche market compared to other corporate financing products such as corporate bonds or classic loans. However, it recently received a lot of attention as the growing market is accompanied by an unseen spring of new ventures that offer digital services in the course of the issuing process: Just in the past two years, nine new digital platforms emerged. Certainly, this is not only due to the strong growth in the segment, but also due to the specific features the Schuldschein inherits. In its traditional form, the Schuldschein process contains several inefficiencies that just call to be tackled by a digital solution. Various platform initiatives are experimenting with different solutions as e.g. blockchain technology, rendering the Schuldschein both a starting point for digitizing financial instruments and a hotbed for digital transformation initiatives.

A handy use case – the Schuldschein and digitization

Besides its growing popularity, the Schuldscheindarlehen is by definition a rather uncomplicated and efficient instrument to issue: Classified as a bilateral loan agreement by the German Civil Code, it is exempted from any complex MiFID II regulations and hence allows for an issuing process that is highly standardized and has no need for cost-intensive and time-consuming documentations.

Schuldscheindarlehen

The Schuldscheindarlehen is a deed-based private placement, originating in Germany. The absence of any securities prospectus requirements and low documentation obligations endorses a high degree of flexibility and makes the process of a Schuldschein significantly quicker and cheaper compared to issuing a corporate bond. As unsecured loans with non-restrictive covenants, tapping volumes above a classic loan is possible, without having to go through all the costly efforts of a bond. With a typical maturity of 3-10 years, the typical deal volume is about EUR 175 million. Investors are mostly banks, while issuers are large enterprises from the industry sector. Find out more in our related Schuldschein article.

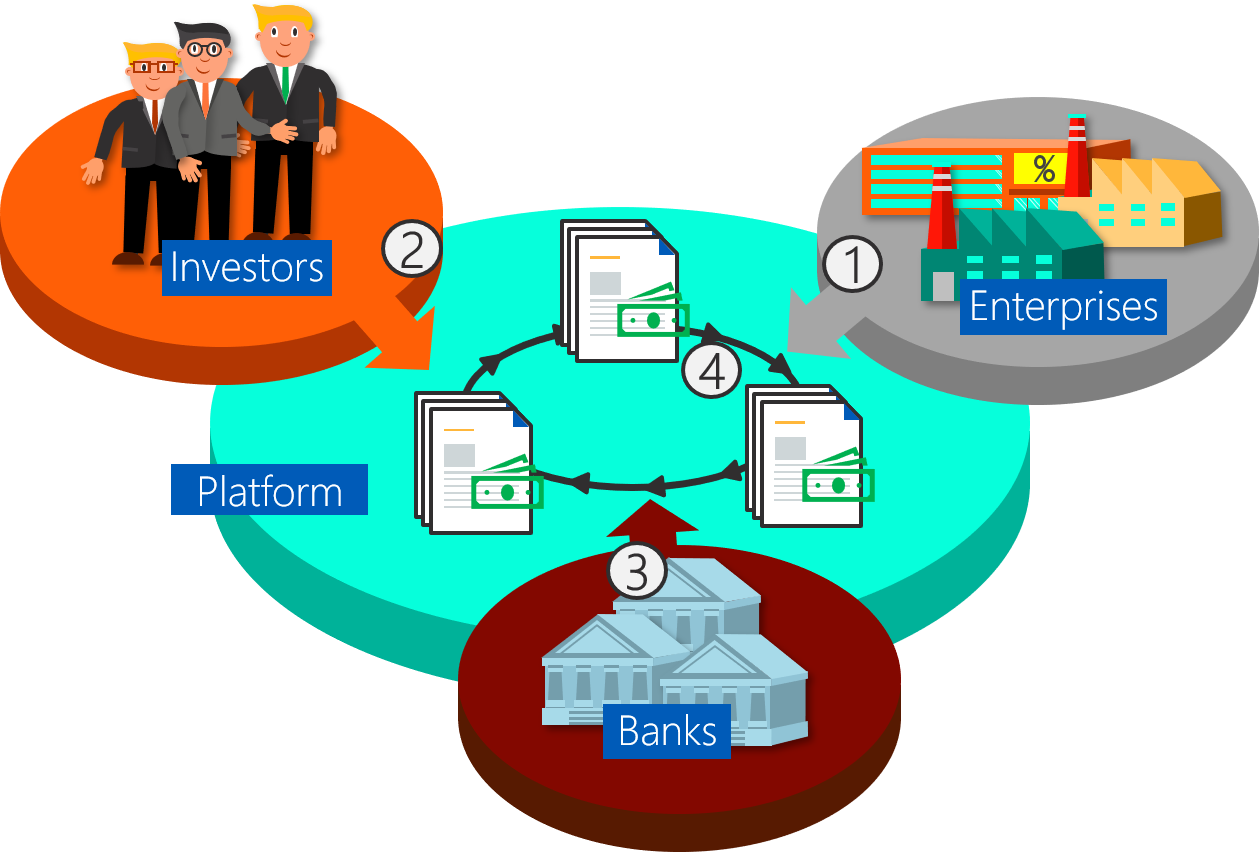

However, most of these benefits are offset by the fact that the traditional process consists of various manual steps, being time-consuming and driving transaction costs. The deed-based instrument requires multiple interactions between stakeholders, cumbersome paper-based back-and-forth iterations and avoidable transaction costs, especially when it comes to connecting issuer and investor. At the same time, many of the steps have traditionally required a third party – usually a bank – as an arranger, responsible for structuring, marketing, settlement supervision and, foremost, providing the network, where issuer and investor get connected.

The Schuldschein makes thus a handy use case for digital transformation undertakings: Digitizing the core process is easy and investors as well as issuers benefit from improved efficiency, a high degree of standardization, more transparency and a larger network of stakeholders.

What's up on the market

Currently, about 13 platforms are on the market offering digitized Schuldschein solutions. The platform boom is bringing the Schuldschein to new levels in terms of attracting larger issuers, such as Lufthansa or Daimler, as well as in terms of transaction volumes: Just recently, a record volume of EUR 2.1 billion has been reached with the help of the platform VC-Trade [9]. Also in the other direction, smaller issuers benefit from the digitization as smaller transaction volumes are getting feasible, too, due to efficiency improvements.

The digitization of the Schuldschein is, however, not completed yet. Most platforms are able to cover the entire lifecycle, i.e. the structuring, marketing and book building phase, settlement and post settlement services. However, since the Schuldschein is a deed-based instrument, the crucial part of signing the certificate of subscription (Zeichnungsschein in German) still has to be done analogously in the presence of a solicitor. Although recent attempts to cover this last piece with the help of the blockchain technology were technically successful, the regulation authorities (BaFin) have not officially approved this method, yet.

Figure 1: Overview of the steps of the Schuldschein process: The largest part of the process can be covered by platform solutions, only signing the certificate of subscription is not approved for digital platform solutions, yet. Source: Finbridge

Platforms – what are they doing?

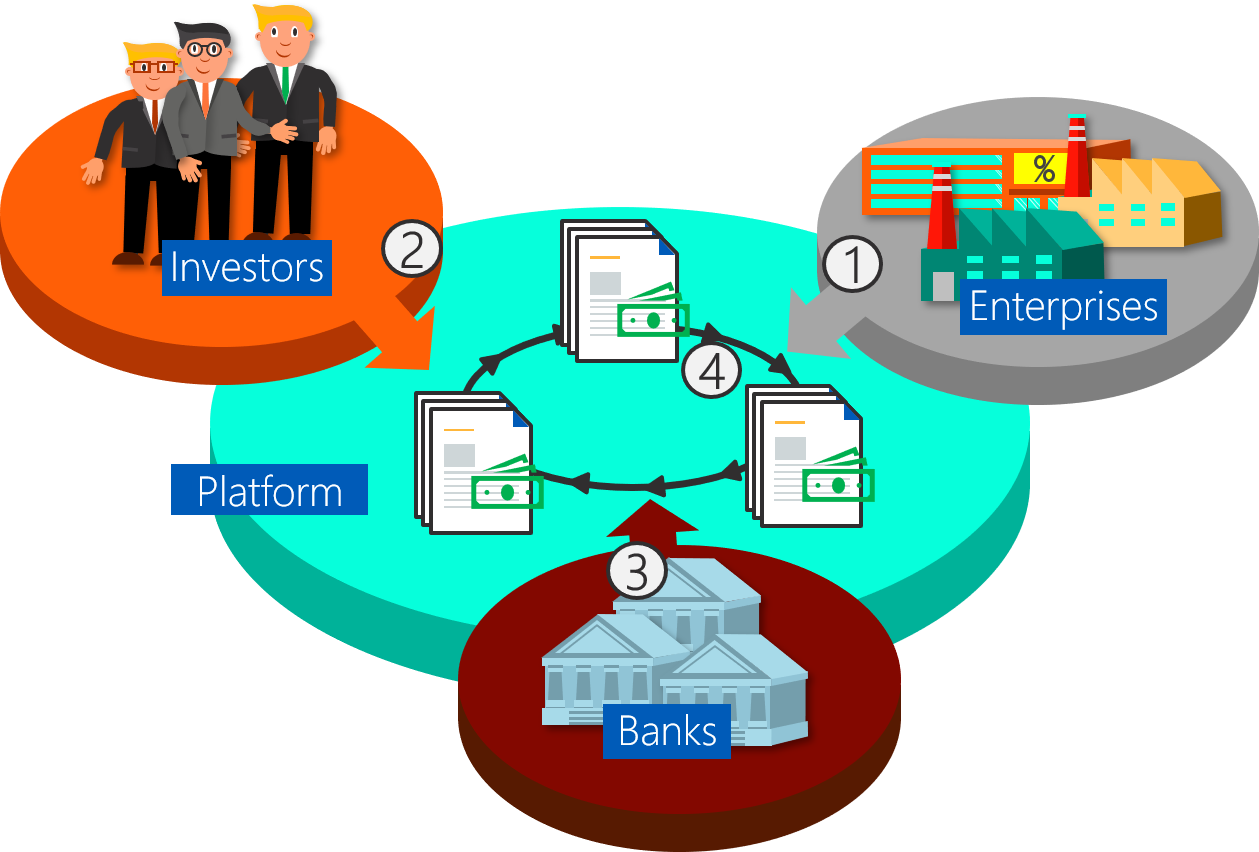

With many platforms crowding the market, identifying the distinctive features is not easy anymore. Technically, all platforms form a front-end market space for all involved agents – banks, investors and issuers – mostly aimed at economizing transaction, financing and liquidity costs.

Generally, through digital Schuldschein placements, a wide range of investors can connect to a broad band of issuers and allow for bespoke placements at hardly any cost. While potential issuers in most cases get pre-screened for their investment grade, investors joining platforms are already sure to acquire a Schuldschein at low risk. Providing documentation sheets and distributing the relevant files via the platform makes the process time-efficient and transparent. Financing and liquidity costs can be cut through transparently offering and allocating bespoke tranches and maturities to a broader community, like in a bidding.

While offering more or less the same service, the platforms pursue different strategies. Some initiatives believe in the digitization of the whole sector and aim to scale down the banks’ role as arrangers. Others believe in the cruciality to involve banks as strong partners into the process and that a platform should be open to as many agents as possible to bring a true and sustainable benefit. Roughly, platforms on the market can be categorized into three different groups:

Proprietary solutions by banks aiming to digitize/ improve their processes.

Multi-arranger solutions founded by banks or FinTechs, aiming to bring together as many investors, banks and issuers as possible.

Neutral solutions, mostly by bank-independent FinTechs, aiming to gradually detach the Schuldschein from the banking sector and lurking to challenge the classic role of a bank as an arranger.

Figure 2: Timeline of platform initiatives that were established since 2016. Source: Finbridge

*Time of the first issue.

Public banks are at the forefront of bank-founded platforms

The Schuldschein market is traditionally led by German and Austrian public banks (Landesbanken or Genossenschaftsbanken). Consequently, this sector is also at the sharp end of introducing digital, more efficient variations of this product. Currently Debtvision (LBBW and Stuttgart Stock Exchange), Yellowe (RBI) and Finpair (Nord/LB) are on the market. The platform Synd-X from HSBC represents a platform founded by a private sector bank.

Debtvision was one of the first bank-founded initiatives offering a digital Schuldschein and, at the same time, has evolved being one of the top dogs in the business. The platform sees no genuine value added in the banks’ role of arranging the Schuldschein. Rather it advocates a shift of the banks’ business case away from its arranger role towards deal- and structuring-advisory – with the remainder of the process being handled bank-independently. Debtvision claimed that up to one third of all transactions have already been self-arranged with the leading-edge example of a recent EUR 50 million deal from Schott AG. Debtvision has channeled Schuldscheindarlehen for i.a. Porsche, the KfW, BayWa GmbH and the State of Baden-Württemberg with a total volume far above EUR 6 billion. Before establishing Debtvision, the LBBW has also successfully experimented with blockchain technology, however stated to not focus on this technology for the moment [3][4][5][16].

The RBI’s own platform Yellowe and HSBC’s Synd-X can be seen as typical proprietary solutions. While the RBI is also active in other platforms, Yellowe is not meant as another competitor on the market. Rather, the platform is supposed as the banks’ own complementary solution suited for the regional branch market to service smaller transaction volumes [6].

HSBC’s Synd-X is currently enabling digital Schuldscheindarlehen and n-bonds of all sizes. Although issuers are given the opportunity to market their placement themselves via the platform, Synd-X believes in the cruciality of banks throughout the process as e.g. paying agencies that provide security as well as processing standards and secure legal compliance throughout the process [7]. Although founded and owned completely by HBSC, Synd-X aims to be a multi-arranger platform, open to other banks joining the platform and open to expand to other products in the future as well. The first deal has been with the leasing company Grenke AG. As a feature, Schuldschein roadshows can be arranged via the MyDeal app.

Figure 3: The traditional Schuldschein process. The Bank acts as only intermediary between investor and issuers. All documents and payments are distributed via the bank. Source: Finbridge

Athough founded by the Nord/LB, the platform Finpair acts now completely independent. The target is to improve efficiency and thus also being able to offer smaller transaction volumes. Through onboarded third-party agents, such as rating agencies or legal advisors, the platform aims to make the banks’ classic arranging role obsolete [8].

FinTechs are crowding the market

Although banks traditionally are strongly involved in the Schuldschein market, they are not the only players. As with other digital transformation topics, FinTechs have been in the wings from the very beginning – some even before the leading banks did – trying to secure their stakes in the booming market.

One of the most promising candidates is the bank-near platform VC-Trade by the Frankfurt-based FinTech Value Concepts. Together with Debtvision, VC-Trade currently is leading in terms of deals and total transaction volume. However, in contrast to Debtvision, VC-Trade emphasizes the criticality of strong banks in the process of Schuldschein issues and hence offers only bank-arranged deals. Partnering with traditional market leaders such as Helaba, BayernLB, Commerzbank, and currently 6 more banks, the platform positions itself as a multi-arranger platform. Currently, the platform pools more than 400 investors and offers innovative co-operations with legal advice firms such as Linklaters and White & Case. VC-Trade also fosters its reputation as an enabler of yet unreached big deals. After an EUR 800 million deal for the Lufthansa in 2018, it recently conveyed a record deal of EUR 2.1 billion with ZF [9] [10] [11] [12].

Figure 4: The Schuldschein process via a platform: 1) The issuer enters the platform network after having passed a check (credibility or investment grade rating), 2) Institutional investors get attracted to the platform by the large base of trusted issuers, 3) Banks enter the platform and can take on either roles of an arranger, advisor or gatekeeper, 4) All kinds of documents and payments can be channeled through the platform. Source: Finbridge

FinTechs as the banks’ competitors

In contrast to the concept of VC-Trade, there are other FinTechs on the market, believing that the inefficiencies of the traditional Schuldschein can also be tackled bank-independently. The Cologne-based FinTech Firstwire, for instance, entered the market already in 2016, long before the leading banks did. Firstwire believes that more and more companies desire their own access to the capital market, in the absence of banks. Thus, the strategy is to gradually detach corporate financing products from the banks’ intermediary role and at the same time to reduce the granularity in the market. The platform focuses on plain vanilla deals with a bespoke (professional) investor circle and currently serves the segment of Community financing. Besides Schuldscheindarlehen, also covered bonds and n-bonds should be offered in the future [13].

Also based in Cologne, CredX defines itself as a neutral platform, where self-arranged as well as bank-arranged Schuldscheindarlehen are possible. Their first deal was a EUR 50 million Telekom Schuldschein in February 2018. With already more than 140 investors the platform acts as a broker for Schuldscheine, n-bonds and other bonds for medium and large companies, targeting transaction volumes from EUR 10 million onwards [14].

FinnestPro is a platform by the Austrian crowdfunding platform Finnest, founded with the intention to enlarge the range of products to higher transaction volumes of up to EUR 25 million. They have recently merged with the Finnish company Invesdor, owning a MiFID II license. FinnestPro seeks expand its business Europe-wide and offer also other products than the Schuldschein, such as bonds, via its platform [15].

The Blockchain experiment

Besides the “normal” platform solutions, several initiatives have experimented with digital platform innovations using distributed ledger technologies (DLT) in the past. In August 2018, the Austrian Erste Group stated to have processed the first entirely digitized Schuldschein with its Ethereum-based blockchain platform, having channeled a EUR 20 million transaction for ASFINAG with investments from inter alia Wiener Städtische Versicherung and Donau Versicherung. Also, the Spanish BBVA organized a EUR 200 million deal for the Madrid Regional Government in April 2019. Another blockchain-based venture is Finledger, a joint project of the Helaba, DeKaBank, DZ-Bank and dwpbank, which had their issue debut in May this year (2019) [17] [18] [19].

The idea of using blockchain technology thereby goes beyond digitizing the Schuldschein process itself. Blockchain solutions have the capacity to reduce process risk, enhance transparency and security, and, technically, make intermediators dispensable. Based on distributed ledgers, consensus mechanisms automatically and irreversibly verify transactions, making a legal solicitor obsolete. Smart contracts support business logics and post settlement services, enhancing a seamless allocation and documentation of information.

Compared to “normal” digital solutions – for the deed-based Schuldschein – using DLT would thus be mainly beneficial by digitizing the last piece of the process – signing the certificate subscription. However, distributed ledger technology does not solve the Schuldschein’s remaining problems per se: Firstly, although technically possible, the legal embedment and regulations of blockchain-issued financial instruments is not yet clarified. Secondly, as opposed to a digital platform, blockchain is more complex and expensive to develop. It further bears some risk of customer aversion, due to the lack of trust in this rather untapped technology. Thirdly, no digital process has the ability to make sure that the loan will be paid back at the end of the day. Due diligence and credibility checks still require offline effort.

Conclusion

With the growth of the Schuldschein market, various platform initiatives have popped up, realizing that the Schuldschein makes an ideal use case for the digitization of financial instruments. With other instruments, such as n-loans or synloans, already being in the pipeline, the Schuldschein market has become a hotbed for digital innovations.

Many of the existing platforms come from the classic Schuldschein market leaders, such as LBBW, Helaba, RBI and HSBC. However, some FinTech platforms have saved their stake in the market as well. Having a large number of platforms on the market, a consolidation is to be anticipated. The current market leaders, Debtvision and VC-Trade, strive for opposite strategies: the big question is, whether the new platforms will render any intermediate party, such as banks as arrangers, legal solicitors or rating agencies, obsolete. While it is technically possible to issue a Schuldschein entirely without involving a third party, some platforms stress that the role of banks is still crucial as a gatekeeper for investors and deal advisors or just as a guarantor for the issuers’ trust. Others believe in a digitized market without intermediaries. While blockchain technology could theoretically promote this view, it is still too costly and complex to be beneficial for a niche market, like the Schuldschein market still is. We are keen to observe further developments in the market and to see, which platform solutions will prove to be sustainable.

REFERENCES:

[1] “Schuldschein: Starkes 3. Quartal Dank hohem Liquiditätsbedarf”, article, Capmarcon Capital, 10/21/2019.

[2] “Schuldschein sizes up digital crowd as 11 compete for crown”, Globalcapital.com, visited 11/05/2019. https://www.globalcapital.com/article/b1fwmkypwjm8cx/schuldschein-sizes-up-digital-crowd-as-11-compete-for-crown

[3] “Debtvision Newsroom”, Debtdomain, visisted 11/05/2019. https://www.debtvision.de/news/

[4] Interview with Head of Debtvision, Finance-TV, visited 11/02/2019. https://www.finance-magazin.de/finance-tv/debtvision-chef-steinbrich-es-wird-zu-einer-konsolidierung-der-schuldscheinplattformen-kommen-2040401/

[5] Interview with Head of Corporate Finance from LBBW, Finance-TV, visited 11/02/2019. https://www.finance-magazin.de/finance-tv/blockchain-schuldschein-effizienzsteigerungen-von-50-prozent-1409151/

[6] “RBI zieht mit digitaler Schuldscheinplattform nach”, Der Treasurer, visited 11/03/2019.

[7] “HSBC Deutschland startet Schuldschein-Marktplatz Synd-X”, HSBC, visited 11/04/2019.

https://www.about.hsbc.de/de-de/news-and-media/hsbc-digitale-schuldscheinplattform-syndx

[8] Finpair faq website, visited 11/05/2019. https://faq.finpair.de/

[9] “VC-Trade – about us”, VC-Trade, visited 11/05/2019. https://www.vc-trade.de/welcome/#aboutus

[10] Interview with Head of VC-Trade, Finance-TV, visited 11/02/2019. https://www.finance-magazin.de/finance-tv/vc-trade-chef-fromme-der-schuldschein-ist-weitgehend-ausdigitalisiert2047171/

[11] Interview with Head of Capital Markets of Helaba, Finance-TV, visited 03/11/2019, https://www.finance-magazin.de/finance-tv/digitale-plattformen-stueckkosten-fuer-schuldscheinemissionen-sinken-deutlich-2018721/

[12] “Schuldscheinplattform VC-Trade führt E-Signatur ein“. Der Treasurer, visited 11/04/2019. https://www.dertreasurer.de/news/software-it/schuldscheinplattform-vc-trade-fuehrt-e-signatur-ein-2010291/

[13] Interview with Firstwire founder, Finance-TV, visited, 11/06/2019. https://www.finance-magazin.de/finance-tv/firstwire-gruender-johannes-haidl-erster-corporate-deal-in-sicht-1396421/

[14] Interview with Head of CredX, Finance-TV, visited 11/02/2019. https://www.finance-magazin.de/finance-tv/credx-ceo-ralf-kauther-cfos-und-investoren-behalten-die-kontrolle-2012341/

[15] “Finnest und skandinavische Invesdor bilden Invesdor Group”, Finnest, visited 11/05/2019. https://www.finnest.com/finnews/finnest-merger

[16] “LBBW baut Plattform für Schuldscheine aus“. Finance Magazin, visited 11/ 02/2019. https://www.finance-magazin.de/finanzierungen/schuldscheine/lbbw-baut-plattform-fuer-blockchain-schuldscheine-aus-2008691/

[17] “ Erste Group und ASFINAG bringen die erste in Europa zur Gänze auf Blockchain basierende Kapitalmarktemission erfolgreich auf den Markt”, Erste Group, visited 11/07/2019. https://www.erstegroup.com/de/news-media/presseaussendungen/2018/10/23/papierlose-ssd-blockchain

[18] Finledger website, visited 11/06/2019. https://www.finledger.de/

[19] BBVA and Madrids Government Close First Blockchain-Powered Sustainable Schuldschein”, BBVA, visisted 11/02/2019. https://www.bbva.com/en/bbva-and-madrids-government-close-the-first-blockchain-powered-sustainable-schuldschein-loan/