Hedge Accounting [Part 1]: Prospective Testing and the Risk Induced Fair Value

In response to the criticism of the accounting rules by the G20 during the course of the financial crisis, the IASB regulations in the International Financial Reporting Standard 9 (IFRS 9), which were first published on 24 July 2014, came into effect within the EU on 1 January 2018. One of the aims of these regulations was to replace the previous approach of the International Accounting Standard 39 (IAS 39) and to achieve a stronger alignment with the risk management strategy pursued by (publicly traded) entities, particularly in the field of hedge accounting.

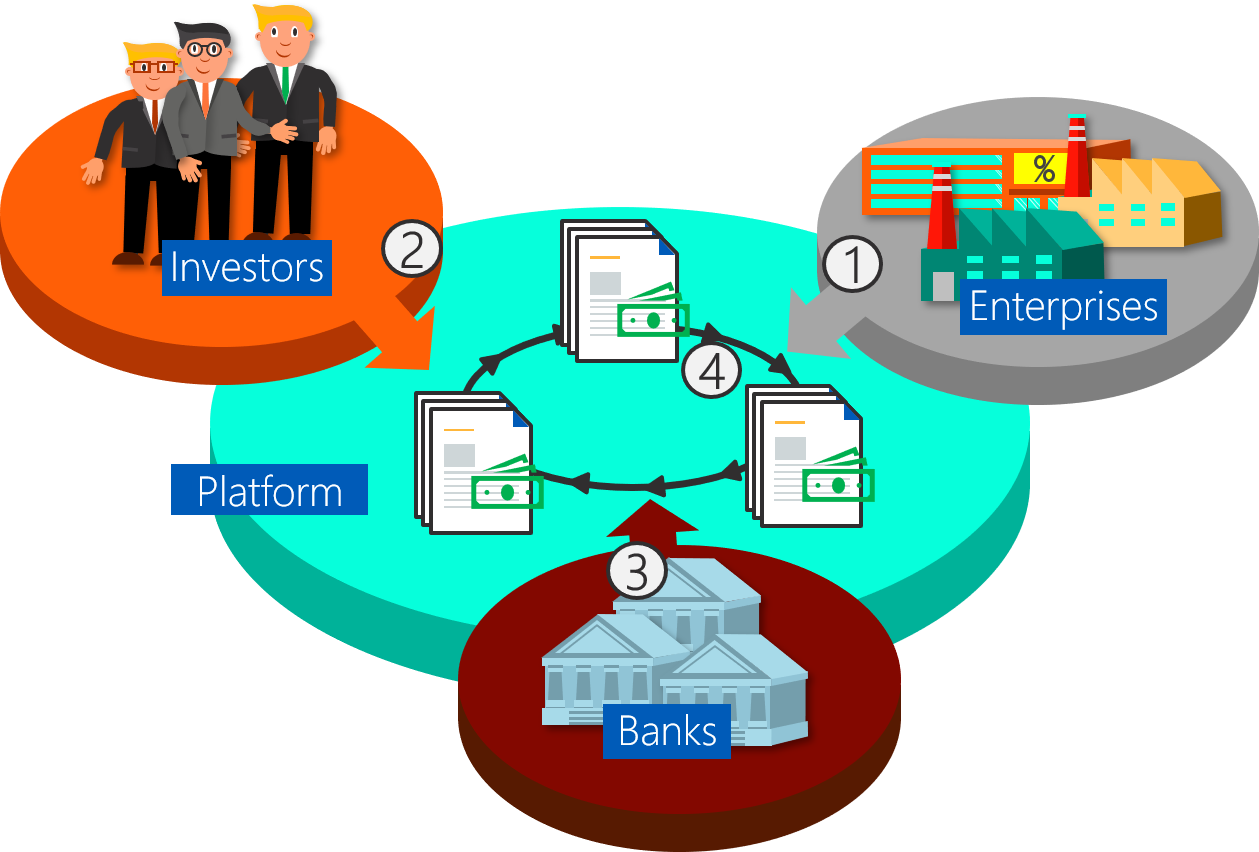

As a result, banks and other institutions are confronted with the necessity of reviewing their hedge accounting strategy. One of the required adjustments is the future accounting treatment of designated hedge relationships between hedged items and hedging instruments (see Figure 1), whereby the prospective effectiveness test, which is relevant for measuring the effectiveness of such a relationship, becomes increasingly important. The test is used for the prospective classification into effective and ineffective hedge relationships and is prescribed in the new standard along with numerous other new changes and improvements.

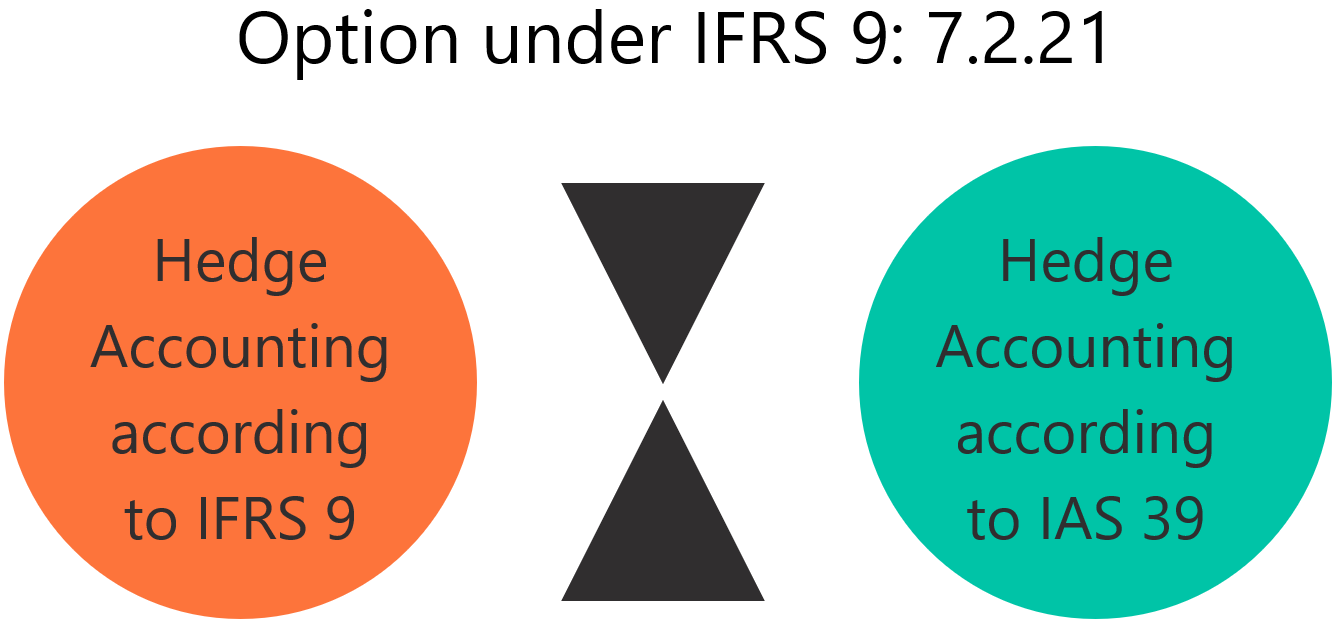

The first part of this publication [Part 1] describes the regulatory hurdles encountered when implementing prospective testing, while the second part [Part 2] presents a concrete implementation option based on the Risk Induced Fair Value ("RiFV"). In view of the quite extensive switch to IFRS 9 regarding hedge accounting, it may be worthwhile for financial institutions to consider the option in IFRS 9 to still determine the effectivity of hedge relationships based on IAS 39 rather than IFRS 9 during a transition phase.

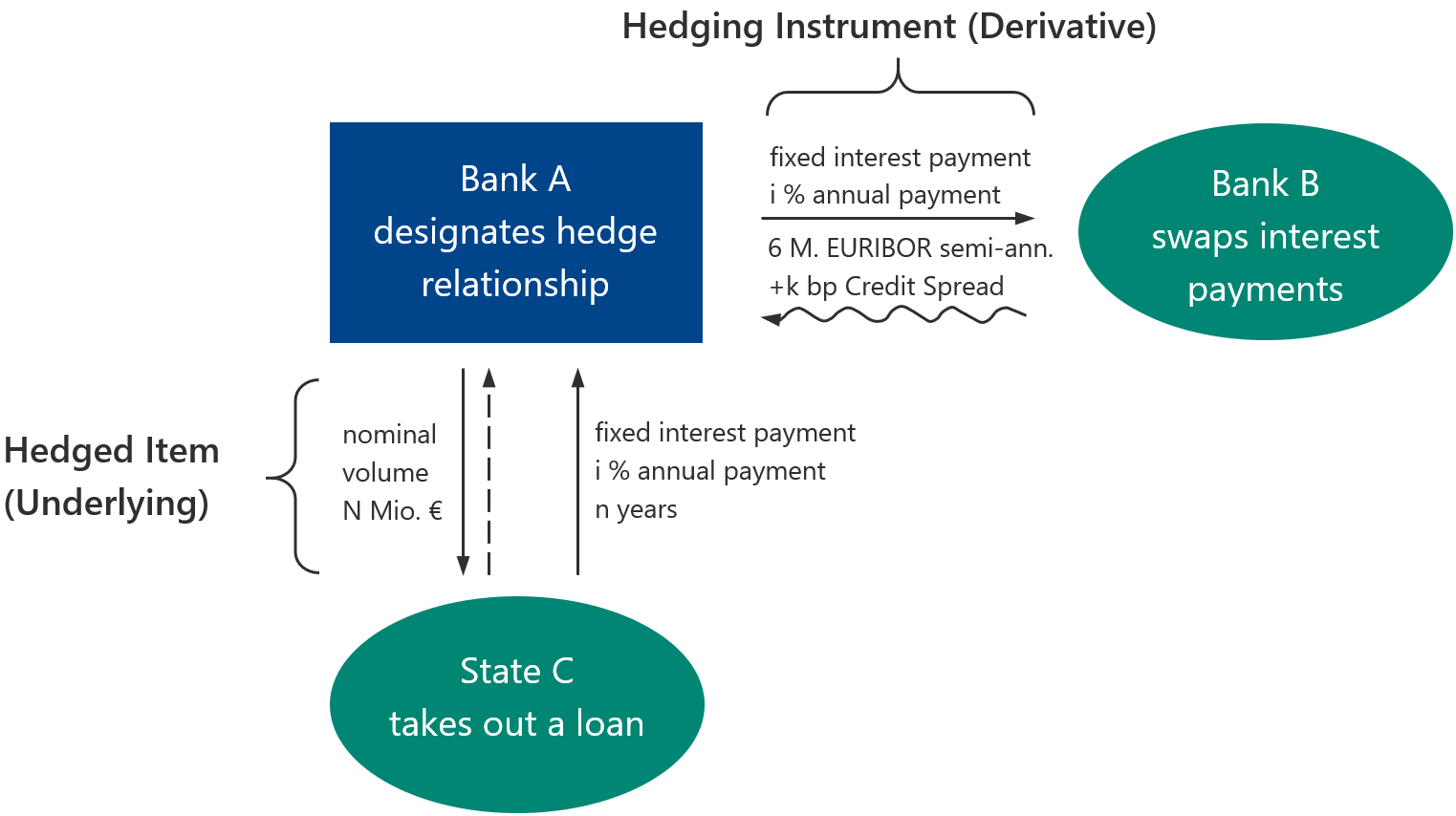

Figure 1: Example of a designated hedge relationship from the perspective of Bank A. Here, the interest rate market risk is hedged by an interest rate swap.

Option in IFRS 9

“The new IFRS 9 standard was endorsed by the EU in November 2016 through Commission Regulation (EU) 2016 / 2067 and its application became mandatory on 1 January 2018 for all publicly traded entities when accounting for financial instruments […].”[1]

The risk management strategy of a company includes measures of risk identification and risk or risk performance measurement, respectively. For example, an underlying transaction (comprising all changes in cash flows or fair value), an underlying component or a group of underlying transactions may fluctuate in value and can therefore be hedged with an eligible hedging instrument (derivative or non-derivative asset) by means of a designated hedge relationship that fulfils relevant criteria in terms of regulation. The objective when accounting for hedges is to reflect the effect of an entity's risk management measures in the financial statements in cases when it uses financial risk management instruments that could affect profit or loss (or other comprehensive income). The accounting requirements for financial instruments are manifested in the regulations of IFRS 9, which are mandatory since 1 January 2018, and which set themselves the goal of completely replacing the originally applicable International Accounting Standard 39. Phase 3 of IFRS 9 deals with hedge accounting and regulates the prospective and retrospective approach (see Figure 2) for assessing the effectiveness of a hedge relationship (prospective and retrospective effectiveness test).

Figure 2: Prospective and retrospective test in hedge accounting[2]

The objective of IFRS 9 is, on the one hand, to better reflect the risk management activities in accounting and, on the other hand, to reduce the complexity and simplify the application of the former regulations. This applies in particular to the significantly relaxed restrictions on transactions that can be hedged ("hedged items") and is in contrast to the old standard. [IFRS 9: 7.2.21] also states that when IFRS 9 is applied for the first time, an accounting option can be exercised to continue to account for hedge relationships in accordance with IAS 39 instead of the hedge accounting rules set out in this standard.

“When an entity first applies this Standard, it may choose as its accounting policy to continue to apply the hedge accounting requirements of IAS 39 instead of the requirements in Chapter 6 of this Standard.”[3]

Figure 3: Transitional provision for hedge accounting: Option in IFRS 9

This option gives banks and other financial institutions the flexibility to postpone the transition in a short and medium term. IAS 39 defines, among other things, rules for the recognition and measurement of derivatives and for hedge accounting, which, as mentioned previously, regulates the accounting treatment of opposite value changes of underlying and hedging transactions.

In order to assess the effectiveness of a hedge relationship, a hedge is regarded as highly effective only if both of the following conditions are met (IAS 39 A105):

1. At the inception of the hedge and in subsequent periods, the effective compensation for the risks from changes in fair value or cash flows related to the hedged risk must be estimated and effectively demonstrated. The demonstration of this expectation can be provided in various ways, e.g. by considering fair values or the statistical correlation between the hedged item and the hedging instrument (IAS 39 A105 (a)).

2. The actual results of the hedge are within a range of 80-125 per cent (IAS 39 A105 (b)).

IAS 39 A106 defines the time at which the effectiveness of hedging instruments is assessed, which must be no later than during the preparation of the annual or interim financial statements. IAS 39 A107 gives the company the possibility to choose the calculation method for assessing the effectiveness of a hedge relationship - it is based on the company's risk management strategy.

The extensive new changes associated with IFRS 9 include a recalibration of the designated ongoing hedging relationship on the basis of the hedge ratio used as the starting point in accordance with IAS 39:

“On initial application of the hedge accounting requirements of this Standard, an entity:

a. may start to apply those requirements from the same point in time as it ceases to apply the hedge accounting requirements of IAS 39; and

b. shall consider the hedge ratio in accordance with IAS 39 as the starting point for rebalancing the hedge ratio of a continuing hedging relationship, if applicable. Any gain or loss from such a rebalancing shall be recognised in profit or loss. “[4]

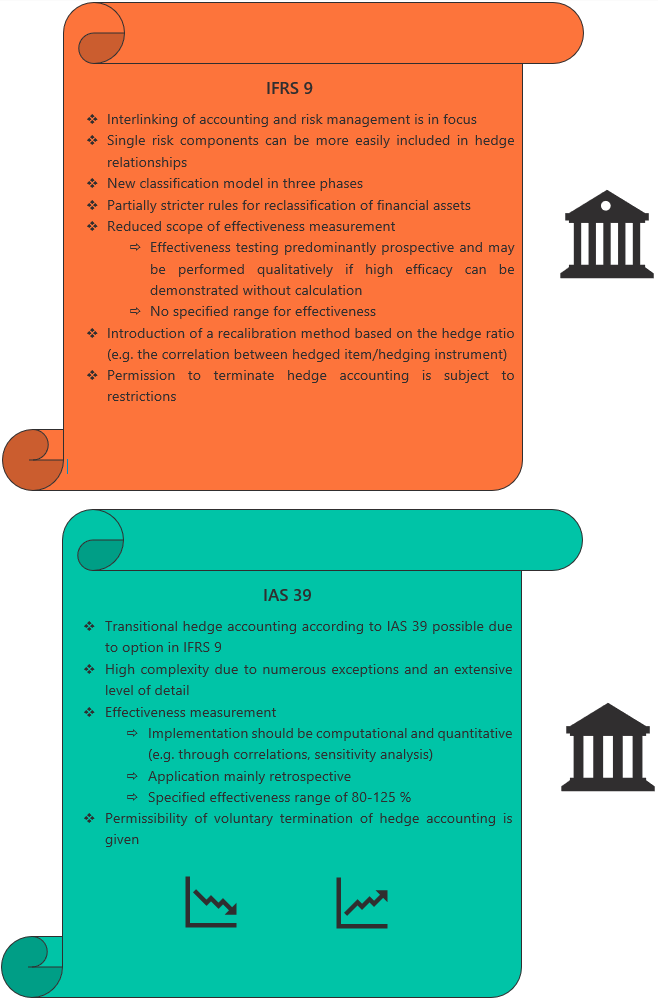

On the other hand, the measurement of effectiveness, which is no longer necessarily quantitative or has to be assessed with the help of a predefined range (in contrast to IAS 39), must be adjusted and is no longer to be applied retrospectively but rather prospectively, unless there are exceptional circumstances[5].

"Except as provided in paragraph 7.2.26[6], an entity shall apply the hedge accounting requirements of this Standard prospectively. “[7]

A comparison between IFRS 9 and IAS 39 regarding the prospective test is shown in Figure 4.

Figure 4: Comparison of the new IFRS 9 standard with the previous IAS 39 standard regarding the prospective test

The new standard therefore demands from banks and other financial institutions to analyse the possible advantages and disadvantages of an immediate transition to the new standard. If appropriate, a softer approach can be taken, which is conditional on a more serious consideration of the prospective test that will be indispensable in the future, with a precise view to the future regulations of IFRS 9.

Conclusion

With IFRS 9, the accounting for financial instruments and thus the effectiveness test in hedge accounting was revised in such a manner that in future the prospective test is, with a few exceptions, to be applied in full. However, at present there is an option for an unspecified period during which IFRS 9 allows transitional accounting in accordance with the former IAS 39 standard. Financial institutions are given the opportunity to adopt a strategy that weighs up the possibilities and advantages of both approaches and one that takes a more serious view on the prospective test that will be indispensable in the future. The considerations should be taken early in accordance with the new IFRS 9 regulations in order to be fully prepared in the ongoing extensive transition.

Our offer

The described regulatory requirements in hedge accounting are related to challenges regarding the future of prospective testing. Depending on these conditions, the test offers extensive application possibilities in a professional environment. The methods and solutions required should be in line with the risk management strategy of the company. We would be pleased to advise you in the context of a preliminary study in the analysis of possible solution variants of the effectiveness measurement, and also help you to develop the solution which, within the framework of the professional and technical possibilities, is adequately suited to the risk management strategy of your company.

Based on this, we can also assist you with the professional implementation.

For the implementation of individual solutions, our following core competencies provide significant benefits:

Quick, thorough and cross-sectoral process analysis and support,

Technical and professional know-how in hedge accounting and problem-solving,

Result orientation and integration ability in the development of systematic approaches.

We hope to have piqued your interest in our consulting services and we look forward to hearing from you.

References:

[1] Deutsche Bundesbank, Monthly Report (Engl.) January 2019, p. 76

[2] In the prospective test, the effectiveness of a hedge relationship is generally only tested at the hedge start date or at the beginning of the hedge relationship (time t=0). The test at a later date (t=1) is carried out if the underlying hedge relationship changes.

[3] Official Journal of the European Union, Commission Regulation (EU) 2016/2067 of 22 November 2016, IFRS 9: 7.2.21

[4] Official Journal of the European Union, Commission Regulation (EU) 2016/2067 of 22 November 2016, IFRS 9: 7.2.25

[5] Such an exception might be, for example the accounting for the time value of an option if, in accordance with IAS 39, only the change in intrinsic value was designated as a hedging instrument. [IFRS 9: 7.2.26 a)]

[6] This paragraph provides guidance on measuring effectiveness retrospectively.

[7] Official Journal of the European Union, Commission Regulation (EU) 2016/2067 of 22 November 2016, IFRS 9: 7.2.22

![Figure 2: Prospective and retrospective test in hedge accounting[2]](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1591670159168-L5IFSGJDM01YU3MSSR47/image005.png)

![Hedge Accounting [Part 2]: Prospective Testing and the Risk Induced Fair Value](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1592205162143-L919DBQ2UQF59D4R9WFH/jeff-fan-29ebQh7e78M-unsplash.jpg)

![Hedge Accounting [Part 1]: Prospective Testing and the Risk Induced Fair Value](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1591683719107-BDZ43MTDO65RH9XKXBG6/christopher-burns-FUh6nK3s0po-unsplash.jpg)